A forex trade is the act of buying one currency while simultaneously selling another in order to profit from changes in exchange rates. Forex, short for foreign exchange, is the global marketplace where national currencies are valued and exchanged, commonly referred to as the forex market. It is the largest financial market in the world, operating continuously throughout the working week and supporting everything from international commerce to global investment flows.

When traders say they have placed a forex trade, they usually mean that they have opened a position in a currency pair such as EUR/USD, GBP/USD, or USD/JPY. This position reflects a specific expectation about how one currency will perform relative to another. If the market moves in line with that expectation, the trade generates a profit. If not, it results in a loss. Regardless of the time frame, the underlying mechanics of a forex trade remain the same.

This article explains what a forex trade is, how it works in practice, what drives currency prices, what costs traders should consider, and how to approach forex trading in a structured and disciplined way.

The basic idea behind forex trading

Forex trading is built on a simple principle: currencies have changing values relative to one another. Unlike shares or commodities, currencies are never traded on their own. Instead, they are always traded in pairs, because the value of one currency can only be measured against another.

For example, the EUR/USD exchange rate shows how many US dollars are required to buy one euro. If the price is 1.1000, it means one euro is worth 1.10 US dollars. Any forex trade in this pair represents a view on whether this rate will rise or fall.

The first currency in the pair is known as the base currency, while the second currency is the quote currency. Price movements show changes in the value of the base currency relative to the quote currency, and choosing the right currency pair plays an important role in shaping a trader’s strategy.

What buying and selling mean in a forex trade

In forex trading, the terms buy and sell have a specific meaning. When a trader buys a currency pair, they are buying the base currency and selling the quote currency at the same time. When a trader sells a currency pair, they are selling the base currency and buying the quote currency.

If a trader buys EUR/USD, they are effectively betting that the euro will strengthen against the US dollar. If the price rises, the position can be closed at a higher level for a profit. If a trader sells EUR/USD, they expect the euro to weaken, allowing them to buy it back later at a lower price.

This ability to trade both rising and falling markets is one of the defining features of forex trading and a key reason for its popularity among active traders.

What exactly defines a forex trade?

A forex trade is defined by several interconnected elements that determine its outcome. Every trade involves a specific currency pair, a direction (buy or sell), a position size, an entry price, and an exit price. The difference between the entry and exit prices, adjusted for position size and trading costs, determines the final result of the trade.

Trades are executed through an online trading platform that provides real-time pricing and instant order execution, most commonly using professional solutions such as the MetaTrader 4 trading platform . Traders may close positions manually or allow predefined exit levels to manage the trade automatically.

How forex prices are quoted

Forex prices are quoted using two values: the bid price and the ask price. The bid price is the level at which the market is prepared to buy the base currency, while the ask price is the level at which it is prepared to sell it. The difference between these two prices is known as the spread.

The spread represents one of the main trading costs in forex. When a trader opens a position, the trade initially shows a small loss because it is entered at the ask when buying or at the bid when selling. This is a normal feature of market pricing and applies across all liquid financial markets.

Understanding pips and price movement

Forex price changes are usually measured in pips, which are standard units of movement. For most major currency pairs, one pip represents a price change of 0.0001. For pairs involving the Japanese yen, one pip is typically 0.01.

Although pip movements appear small, their financial impact depends on position size. Successful forex trading is not about chasing large price moves, but about managing the relationship between risk and potential reward. Professional traders focus on controlling losses first and allowing profits to develop within predefined limits.

Position size and trade volume

Forex position size is commonly expressed in lots, which standardise trade volume across the market. A standard lot usually represents 100,000 units of the base currency, while smaller accounts may trade reduced volumes.

Choosing the correct position size is critical for long-term consistency. Rather than focusing on how much profit is possible, disciplined traders determine position size based on how much they are prepared to risk on a single trade. This approach helps protect trading capital during periods of unfavourable market conditions.

Leverage and margin in forex trading

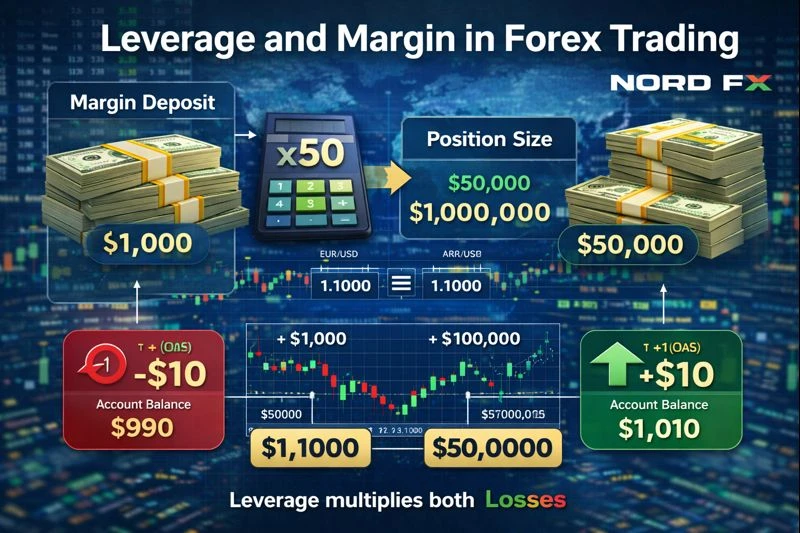

One of the most distinctive features of forex trading is the use of leverage. Leverage allows traders to control larger positions with a relatively small amount of capital, known as margin. While this increases flexibility and market access, it also increases risk.

Leverage amplifies both profits and losses. Even small price movements can have a significant impact on account balance. For this reason, leverage should always be used carefully and combined with strict risk management rules.

What moves currency prices?

Forex prices are influenced by a wide range of factors. Interest rates and central bank policy play a central role, as currencies from countries with higher expected interest rates often attract more investment. Central bank decisions, speeches and forward guidance are closely monitored by forex traders.

Macroeconomic data such as inflation figures, economic growth and employment reports can also affect currency values, especially when results differ from market expectations. In addition, global risk sentiment influences capital flows, with traders adjusting positions during periods of optimism or uncertainty.

Political developments, geopolitical tensions and unexpected policy decisions can also lead to sharp and sudden movements in the forex market.

Forex trading hours and liquidity

The forex market operates twenty-four hours a day during the working week, following the opening hours of major financial centres around the world. Market activity and volatility vary depending on the time of day and the currency pair being traded.

Periods when major trading sessions overlap often see increased liquidity and faster price movement. Understanding when a chosen pair is most active can help traders align their strategies with prevailing market conditions.

Different approaches to forex trading

Forex trades can be held for very short periods or for extended time frames, depending on the trader’s approach. Some traders focus on intraday price fluctuations, while others aim to capture broader trends that unfold over days or weeks. Longer-term traders may base decisions on macroeconomic cycles and central bank policy.

There is no single correct approach to forex trading. The most effective method is the one that can be executed consistently while maintaining disciplined risk control.

Order types and trade management

Forex trades can be entered using different order types. Positions can be opened immediately at market prices or entered automatically at predefined levels. Stop-loss and take-profit orders are used to limit potential losses and secure profits without constant monitoring.

Using predefined exit levels helps turn trading into a structured process rather than an emotional reaction to market movements.

A practical example of a forex trade

Imagine EUR/USD is trading near 1.1000. A trader expects the euro to strengthen and opens a buy position. A stop-loss is placed below the entry level to control risk, while a take-profit level is set above the market to capture gains if the price rises. The trade outcome depends on whether the market reaches the stop-loss, the take-profit, or is closed manually.

This example highlights a core principle of forex trading: risk is defined before the trade is entered, not after.

Trading costs to be aware of

Every forex trade involves costs that influence overall performance. These include spreads, possible commissions, overnight financing charges for positions held beyond a trading day, and slippage during periods of high volatility. Understanding these costs is essential when evaluating trading results.

What beginners should focus on first

For beginners, the priority should be learning how forex trades work mechanically before attempting complex strategies. Understanding pricing, leverage, position sizing and risk control forms the foundation for long-term consistency.

Keeping trading simple, avoiding excessive leverage and maintaining realistic expectations can help new traders avoid the most common mistakes.

Final thoughts

A forex trade is a structured position on the relative value of two currencies within a highly liquid global market. While opening a trade is technically simple, long-term success in forex trading depends on discipline, risk management and a clear understanding of how the market operates.

Risk warning: Forex trading involves significant risk and may not be suitable for all investors. Exchange rates can change rapidly, and leverage can amplify losses. Always trade responsibly and ensure you fully understand the risks before trading.

Go Back Go Back