Cryptocurrencies have moved far beyond their early niche. Today, they form a significant part of global financial markets, with tokens like Bitcoin and Ethereum widely recognised, and others such as BNB, Solana, and XRP increasingly popular among traders. For beginners, one of the most common questions is straightforward: how do I actually buy these assets, especially when they are quoted as pairs like BNBUSD or SOLUSD?

This guide provides step-by-step instructions for buying and trading popular crypto pairs, while also touching on essential risk management practices. By the end, you should feel more confident in approaching the process - whether you want to hold coins in a wallet or actively trade price movements.

Step 1: Understand What a Crypto Pair Is

When you see symbols like BNBUSD or SOLUSD, they represent the price of a cryptocurrency quoted in US dollars.

- BNBUSD shows how much one unit of BNB (the native coin of BNB Chain) is worth in USD.

- SOLUSD shows the same for Solana, another major blockchain asset.

- Other popular pairs include XRPUSD, LTCUSD, and MATICUSD.

By trading or buying these pairs, you are essentially speculating on whether the coin will rise or fall in dollar terms.

Step 2: Decide Between Owning or Trading

There are two main ways to gain exposure:

a. Buying the actual coin – You purchase BNB, SOL, or another token, then transfer it to a personal wallet. This is more like long-term investing.

b. Trading derivatives/CFDs – You trade the pair as a financial instrument, without owning the underlying coin. This gives flexibility to go both long (buy if you expect the price to rise) or short (sell if you expect the price to fall).

Beginners often start with buying coins directly, but understanding both paths helps you choose based on your goals.

Step 3: Set Up Your Wallet or Trading Account

If you buy the actual coins, you will need a crypto wallet. Wallets can be:

- Hardware wallets (devices that store private keys offline, providing strong security).

- Software wallets (apps or browser extensions that give easier access but require good security practices).

Your wallet generates a private key that should never be shared. Losing it means losing access to your coins.

If you prefer trading pairs without owning coins, you need to set up a trading account with a broker or exchange. Here you can deposit funds (USD, EUR, or stablecoins) and start trading directly.

Step 4: Learn How Quotes Work - Bid and Ask

When you open the BNBUSD chart, you will notice two prices:

- Bid – the price at which you can sell.

- Ask – the price at which you can buy.

- The difference is the spread, which represents an immediate cost.

For example, if BNBUSD shows a bid at $590 and ask at $592, the spread is $2. Understanding this basic structure is essential before placing orders.

Step 5: Analyse the Market with Charts

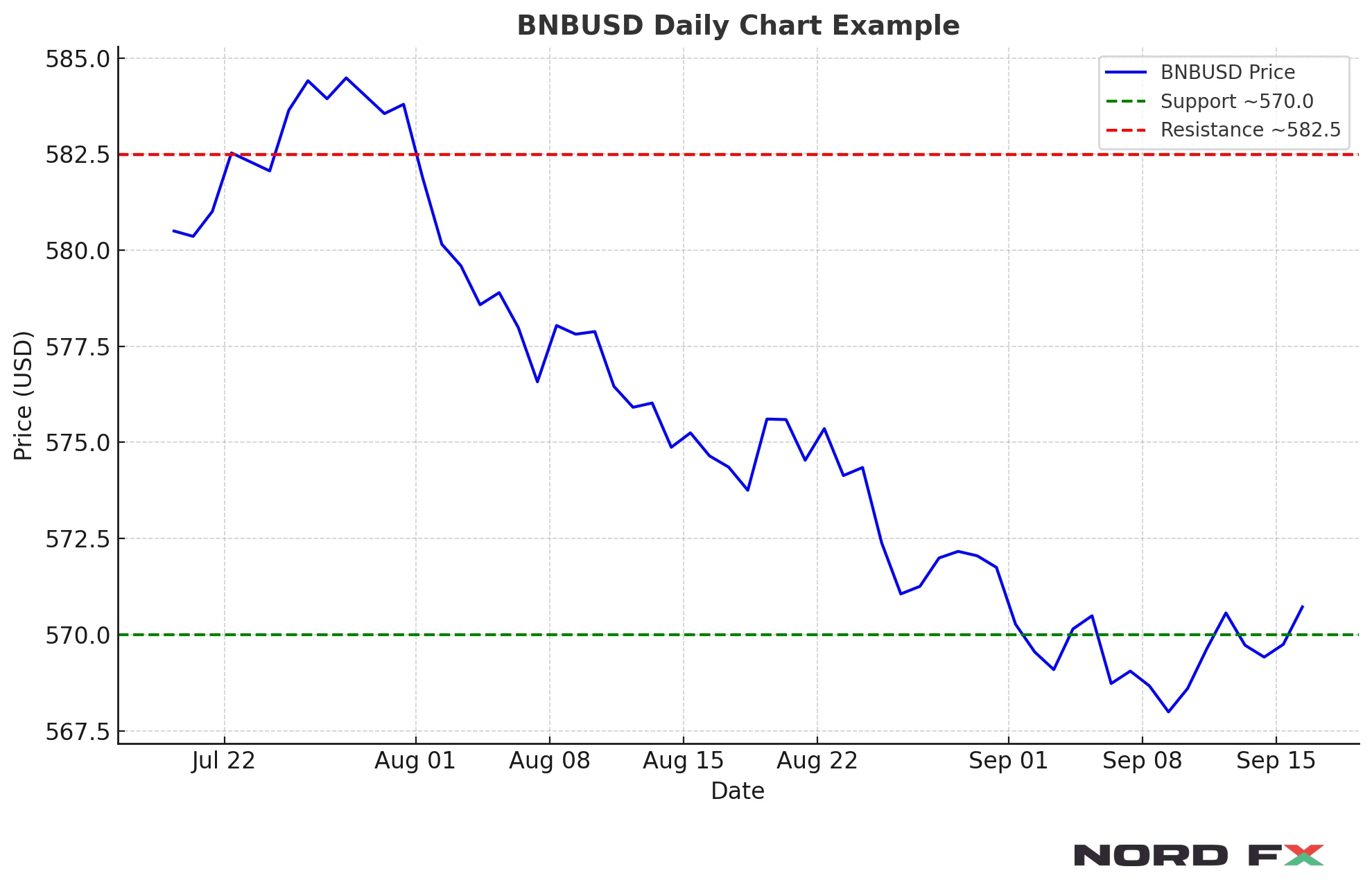

Before buying, it helps to look at a daily chart. This shows how price has moved each day, highlighting trends and volatility.

- Look for support levels (areas where price tends to stop falling) and resistance levels (areas where price struggles to rise further).

- Check for consolidation zones - periods where the price moves sideways, often before a breakout.

Chart analysis doesn’t predict the future perfectly, but it gives you context for when and where to enter the market.

For example, the chart below illustrates recent support and resistance levels on the BNBUSD daily chart, showing how traders often identify entry and exit zones:

Step 6: Choose Your Order Type

When you are ready to buy BNBUSD or SOLUSD, you will usually choose between two order types:

- Market order – buys immediately at the current ask price.

- Limit order – buys only at a specific price you set, giving you more control but no guarantee of instant execution.

Beginners often start with market orders for simplicity, but limit orders are useful when you want to enter at key chart levels.

Step 7: Plan Position Sizing and Risk

One of the most overlooked parts of trading is how much to buy. Position sizing ensures you don’t risk too much of your capital on a single trade.

A common rule is to risk no more than 1% of your total trading capital per trade. For example, with $5,000 in your account, the maximum risk per trade should be $50.

This keeps you in the game even if several trades go against you.

Step 8: Use Stop-Loss and Take-Profit Orders

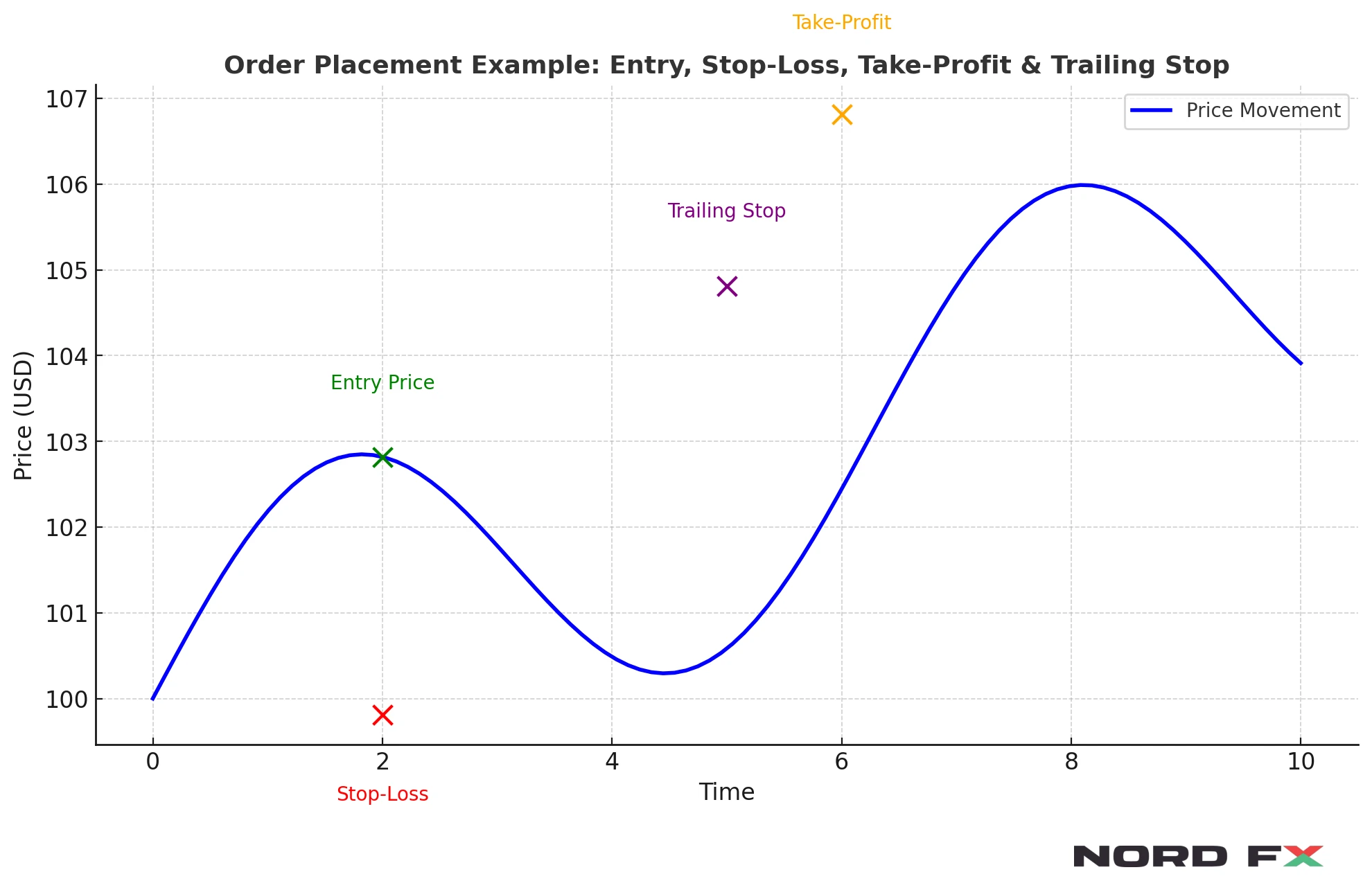

To control risk and secure gains, you can add instructions to your orders such as stop-loss and take-profit orders:

- Stop-loss – closes your trade automatically if the price moves against you beyond a set level.

- Take-profit – closes your trade once the price reaches your target profit.

For example, if you buy BNBUSD at $590, you might set a stop-loss at $570 and take-profit at $620.

An advanced option is a trailing stop-loss, which moves your stop level higher as the market rises, locking in profits while allowing the trade to run further.

The following illustration shows a simplified example of an order setup, marking the entry price, stop-loss, take-profit, and trailing stop:

Step 9: Long vs Short Positions

Buying crypto directly means you benefit only if the price rises. But when trading pairs as derivatives, you can also take short positions.

- Long position – you buy the pair, expecting it to rise.

- Short position – you sell the pair, expecting it to fall.

This flexibility is useful in volatile crypto markets, where sharp swings in both directions are common.

Step 10: Monitor Your Investment and Stay Secure

Once your trade is active, keep an eye on both the market and your own plan:

- Don’t move your stop-loss further away just to avoid being closed out.

- Adjust your trailing stop to protect profits as price moves in your favour.

- If you bought the coin to hold, move it to your wallet and store your backup phrase safely offline.

Security is critical: phishing attacks, weak passwords, or careless storage can result in permanent losses.

Risk Management Tips for Beginners

Even if your main goal is simply to buy and hold coins, basic risk management can save you from major mistakes:

- Avoid investing more than you can afford to lose.

- Diversify - don’t put all your funds into a single token like BNB or SOL.

- Keep records of your trades for future analysis.

- Don’t chase every price move; stick to your plan.

These principles apply not only to cryptocurrencies but to financial markets in general.

Conclusion

Buying crypto pairs such as BNBUSD, SOLUSD, or XRPUSD is not complicated, but doing it responsibly requires planning. From understanding bid and ask prices to choosing a wallet, from studying the daily chart to setting stop-losses and take-profits, every step helps reduce risk and build confidence.

Cryptocurrency markets are known for their volatility, but this can be managed with clear rules, disciplined position sizing, and proper use of orders. For beginners, patience and consistency are more important than speed. By approaching each purchase with a structured process, you can avoid common pitfalls and make crypto a useful part of your wider trading or investment journey.

Go Back Go Back