The global financial markets have seen a mixture of stability and volatility recently. January was marked by central banks meeting market expectations without introducing significant changes. In particular, the US Federal Reserve (Fed) and the European Central Bank (ECB) kept their monetary policies largely unchanged, resulting in fluctuating currency and asset prices. As February begins, key economic reports, including US employment data and European inflation, will play a crucial role in determining market trends for both forex and cryptocurrencies.

The EUR/USD pair fell from its earlier gains last week, ending around 1.0330. After both the Fed and ECB meetings, the broader outlook for this pair remains bearish, with investors keeping an eye on the previous low of 1.0177. Meanwhile, gold prices maintained their upward trajectory as global uncertainty pushed investors towards safe-haven assets. Bitcoin also ended January positively and is poised for potential gains this month, historically a strong period for the cryptocurrency.

EUR/USD Outlook

The EUR/USD pair faced renewed downward pressure last week. The Federal Reserve decided to keep its benchmark interest rate between 4.25% and 4.50%, in line with market expectations. Fed Chair Jerome Powell highlighted that while inflation remains a concern, the Fed sees no immediate need for policy changes unless the labour market weakens or inflation declines more rapidly than expected. The US dollar initially fell after the Fed announcement but quickly regained strength as markets digested the news.

Across the Atlantic, the ECB lowered its key interest rates by 25 basis points, citing subdued economic growth as a primary concern. ECB President Christine Lagarde confirmed that inflation trends remain within expectations, while the Eurozone's Q4 GDP data painted a mixed picture of modest growth. Germany’s economy contracted slightly, and weak retail sales figures added to concerns about sluggish demand in the region.

Technical indicators suggest that EUR/USD remains in a long-term bearish trend. The pair continues to trade below key moving averages, with dynamic resistance around 1.0630. Immediate support stands near 1.0350, and a break below that level could push the pair towards 1.0177. Resistance lies around 1.0450 and 1.0532, levels that need to be breached to signal a reversal.

Gold (XAU/USD) Outlook

Gold markets experienced consistent bullish momentum throughout January, and this trend appears likely to continue into February. Investor demand for safe-haven assets remains strong amidst ongoing geopolitical and economic uncertainties. Although rising US interest rates could pose a challenge to gold prices, the metal's status as a store of value continues to attract buyers.

Gold is currently facing resistance near $2,800, and a break above this level could open the door to a move towards $3,000. Analysts view this as a realistic target, supported by measured price movements over recent months. On the downside, support levels are situated at $2,700 and $2,600. A drop below these thresholds could indicate a deeper correction, though such a scenario appears unlikely given the recent consolidation and resumption of upward momentum.

Traders are advised to monitor US dollar movements and macroeconomic data releases. However, barring any major shocks, gold's long-term uptrend seems intact, with short-term pullbacks likely providing opportunities for accumulation.

Bitcoin (BTC/USD) Outlook

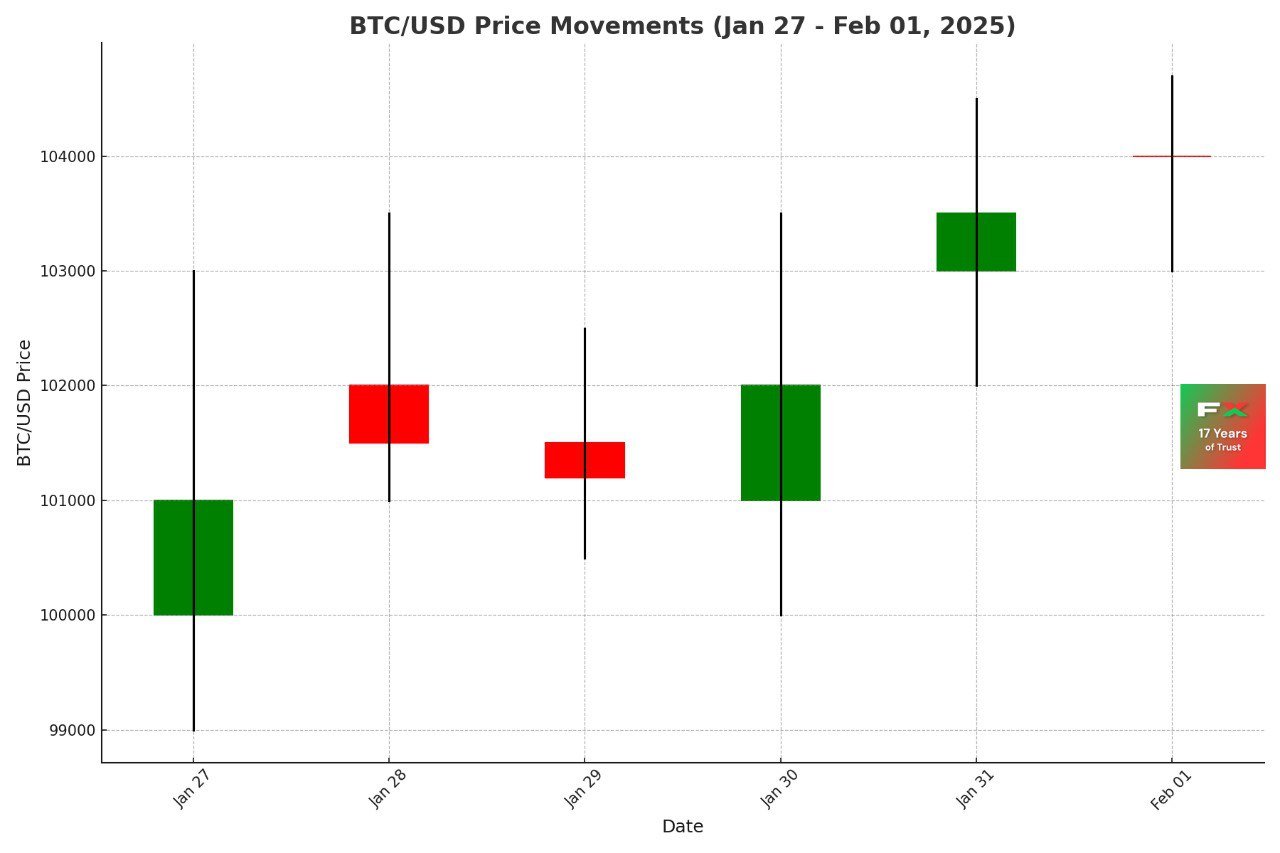

Bitcoin ended January on a strong note, recording gains of over 11%. Historically, February has been one of the top-performing months for the cryptocurrency, with average returns of 15.66%. The price currently hovers around $104,000 after bouncing off support near its 50-day Exponential Moving Average (EMA) at $98,845 earlier this week.

Market reports indicate that a stronger correlation between bitcoin and US equities has emerged. The cryptocurrency saw moderate declines after a sharp drop in Nvidia’s stock price, attributed to concerns over China’s DeepSeek AI technology. This correction led to significant liquidations in the broader crypto market but did not alter bitcoin's long-term bullish outlook.

On-chain data suggests that the current rally bears structural similarities to the 2015–2018 bull cycle. Reduced realised market cap growth and declining exchange balances reflect a more mature market. However, analysts caution against interpreting exchange withdrawals as a sign of imminent supply shock, noting that much of the movement involves coins shifting to ETF custodial wallets.

Technically, bitcoin faces immediate resistance near its recent all-time high of $109,588. The Relative Strength Index (RSI) reads 57, indicating growing bullish momentum. A sustained rise above this level could trigger another rally. Conversely, a break below $100,000 and the 50-day EMA would risk further declines, with key support around $90,000.

Conclusion

As February unfolds, the forex and cryptocurrency markets are at a critical juncture. EUR/USD continues to face bearish pressure, driven by divergent monetary policies and weak economic data from the Eurozone. Gold remains a strong performer amid global uncertainty, with traders eyeing a move towards $3,000. Bitcoin, bolstered by historical trends and improving on-chain metrics, has the potential for further gains this month.

Investors should stay vigilant, keeping an eye on upcoming US employment reports and macroeconomic indicators. These factors will shape market sentiment and determine whether the current trends in forex, gold, and bitcoin extend or reverse in the coming weeks.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.