General Outlook of the Past and Coming Week

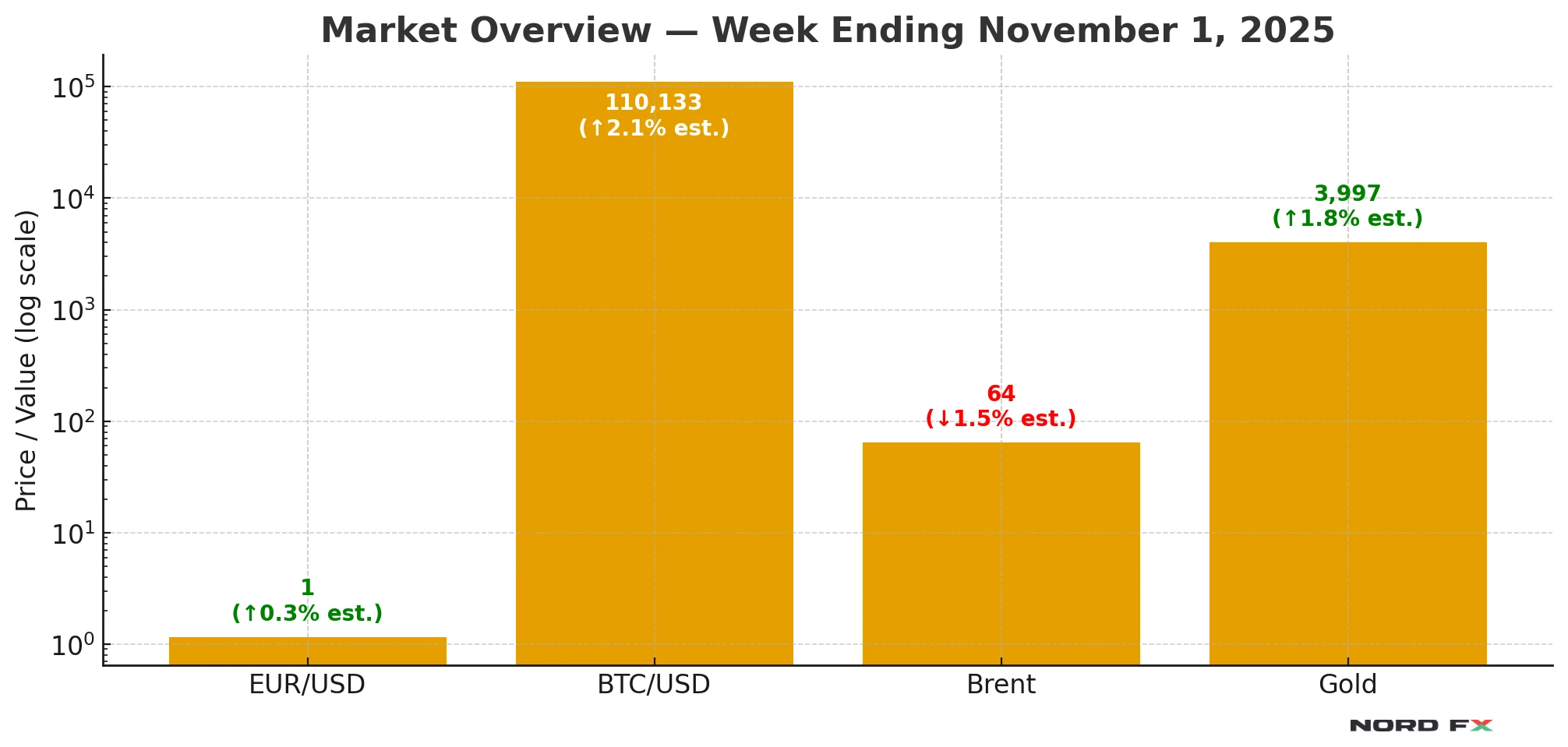

Financial markets closed October in a mixed mood. The Federal Reserve’s 25-basis-point rate cut on October 29 helped calm bond yields but failed to spark a strong risk rally as Chair Powell maintained a data-dependent tone. The US dollar weakened slightly on softer inflation expectations, while the euro held ground after ECB officials signalled rates will stay unchanged through winter. In the UK, the focus is now on Thursday’s Bank of England decision, where markets see roughly even odds of another 25-bp cut from the current 4.00%. In the US, Friday’s Non-Farm Payrolls will test whether the labour market slowdown continues. Commodity markets remain cautious: Brent is consolidating near $64–65 per barrel, gold stays above $3 950 per ounce, and bitcoin is steady around $110 000. We expect sideways trading early in the week and stronger volatility around Thursday–Friday’s central-bank and employment data.

EUR/USD

The euro/dollar (EUR/USD) pair ended last week near 1.1536. Moving averages continue to show a modest bullish slope, yet price action remains trapped between the signal lines, reflecting hesitation among buyers. For the coming week we expect an attempt to push higher toward 1.1655, where resistance is likely to emerge. A rebound from that zone could lead to renewed decline toward 1.1075. Additional bearish signals would include an RSI rejection at its descending resistance line and a price rebound from the resistance region on the chart. A confident move above 1.2045 would cancel the downside scenario and open the way to 1.2325, while a break below 1.1365 would confirm bearish continuation.

Forecast summary: EUR/USD for November 3 – 7 suggests a short-term rise toward ~1.1655 followed by a possible pullback toward ~1.1075. The bullish view becomes valid only above 1.2045; a fall under 1.1365 would strengthen the downside outlook.

Bitcoin

Bitcoin (BTC/USD) finished the week near $110 133 and continues to trade inside a broad bullish channel. Moving averages remain directed upward, and the price again tests the mid-channel zone, indicating sustained buying pressure. This week we expect an initial dip toward $102 505, followed by a rebound and potential growth toward $135 865. A rebound from the lower boundary of the channel and an RSI support-line bounce would reinforce the bullish case. A drop below $92 205 would cancel this scenario and point to further decline toward $75 605. Conversely, a breakout and close above $126 505 would confirm renewed upside momentum.

Forecast summary: BTC/USD for November 3 – 7 implies a test of ~$102 505 support followed by an advance toward ~$135 865. A fall below ~$92 205 would negate the bullish outlook.

Brent

Brent crude oil closed the week around $63.96 per barrel. Moving averages signal a bearish trend, and prices remain below the signal lines, showing ongoing pressure from sellers. We expect a test of support near $63.35 early in the week. If that level holds, a rebound toward $70.85–$76.05 is possible. A clear break below $58.05 would cancel the upside attempt and indicate continued decline toward $52.05.

Forecast summary: Brent for November 3 – 7 points to consolidation near $63–64 with scope for a rebound toward ~$76 if support holds. A drop below ~$58 would shift focus to ~$52.

Gold

Gold (XAU/USD) is trading around $3 997 and continues to move inside a bullish channel. Moving averages indicate an uptrend, and the price has stabilised above the zone between the signal lines, reflecting buying pressure and potential continuation of growth. We expect a short-term correction toward $3 905, followed by a rebound and another advance toward $4 565. A rebound from the RSI trend line or the channel’s lower boundary would support the bullish scenario. A drop below $3 545 would invalidate it and open the way to $2 835. A breakout above $4 165 would confirm further upside momentum.

Forecast summary: XAU/USD for November 3 – 7 suggests a brief correction toward ~$3 905 followed by growth toward ~$4 565. A fall below ~$3 545 would cancel the bullish scenario.

Conclusion

The first week of November is likely to remain dominated by macro headlines. The dollar’s direction will hinge on Friday’s NFP results, while the euro may test resistance before turning lower. Gold should stay supported on dips, Brent appears capped while under $71, and bitcoin remains constructive above $102 000. Caution and position management remain essential as volatility rises late in the week.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.