General Outlook

Markets start the second week of October amid a U.S. government shutdown that has already delayed the September Non-Farm Payrolls and suspended weekly jobless claims. The ISM Services index for September slipped to 50.0 (from 52.0), signalling stalling momentum and keeping rate-cut expectations alive. In the euro area, headline CPI ticked up to 2.2% y/y in September, while the ECB’s Monetary Policy Meeting Accounts on Thursday, 9 October will be combed for clues on the policy path. Gold hovers near record highs after printing an all-time peak around $3,896 last week, and Bitcoin is within sight of its August record near $124k.

EUR/USD

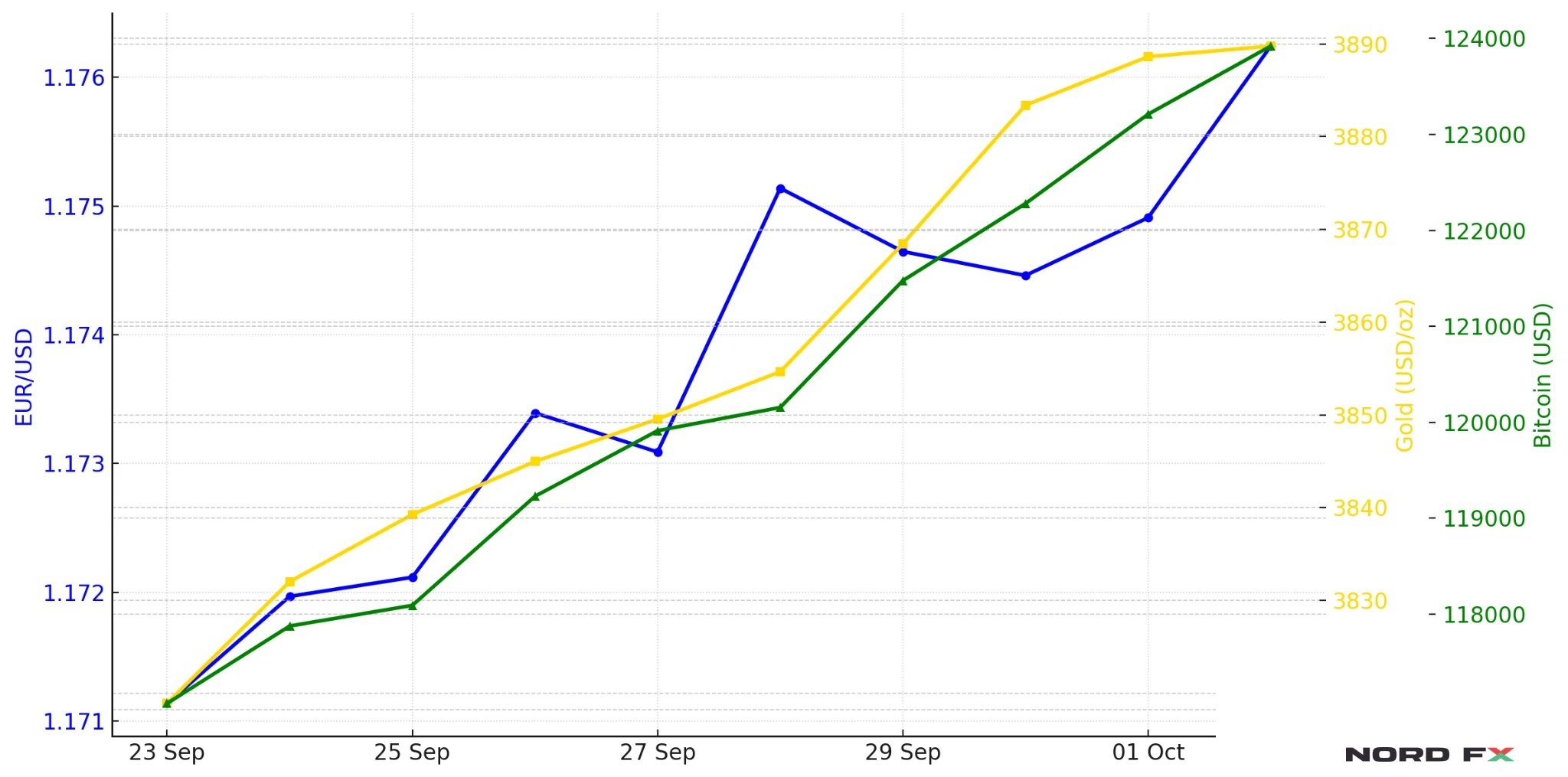

The pair spent the past week in a tight 1.169–1.177 range, with the ECB’s flash CPI firm but hardly hawkish and the dollar softening as U.S. services cooled. Into this week, the focus is on Eurozone Retail Sales (Mon), Germany Industrial Production (Wed) and the ECB minutes (Thu). The dollar side remains hostage to the shutdown-hit data flow after the missing NFP and weaker ISM Services. ECB reference prints for 1–3 October clustered near 1.172–1.175. A sustained move through 1.1760 would open topside tests, while dips should find demand into the mid-1.16s unless the ECB minutes sound unexpectedly hawkish.

- Resistance: 1.1760–1.1800; then 1.1850

- Support: 1.1700–1.1680; then 1.1640

- Trading view: Range with a mild topside bias while above 1.1700; fades favoured into 1.1800 unless ECB minutes or U.S. data shock.

XAU/USD (Gold)

Gold finished the week near $3,860–$3,885, just shy of last Thursday’s record (~$3,896), as the shutdown and softer U.S. services print reinforced the safe-haven and rate-cut narrative. Street research now openly discusses $4,000 risks if policy uncertainty persists. Near-term, bullion takes cues from the dollar and real yields; shallow pullbacks have been met by dip-buyers.

- Resistance: $3,900–$3,940; then $4,000

- Support: $3,820–$3,780; then $3,740–$3,700

- Trading view: Buy-the-dip above $3,780 for re-tests of $3,900/3,940; a decisive USD rebound would risk a move back to $3,740–$3,700.

BTC/USD

Bitcoin rallied to the $122k–$124k area, within about 1% of its August all-time high, riding the same safe-haven and liquidity narrative that has propelled gold. With macro data visibility reduced by the shutdown, crypto has tracked broader risk and USD moves; a clean weekly close above the prior peak would signal fresh breakout momentum, while failure to hold $117k–$114k would flag a deeper pullback to the low-$110ks.

- Resistance: $124k–$128k; then $132k

- Support: $117k–$114k; then $110k–$107k

- Trading view: Momentum-longs while above $117k; fade spikes into $128k if risk sentiment sours.

Key Dates

- Mon 06 Oct: Eurozone Retail Sales (Aug).

- Wed 08 Oct: Germany Industrial Production (Aug).

- Thu 09 Oct: ECB Monetary Policy Meeting Accounts. U.S. Initial Jobless Claims publication suspended during the shutdown.

- All week: U.S. shutdown developments; any ad-hoc guidance from Fed and ECB officials.

Conclusion

For 06–10 October, EUR/USD is range-bound with a slight topside tilt while above 1.1700, pending ECB minutes and European data; gold stays supported on shallow dips as shutdown-era uncertainty and softer U.S. services keep real-yield pressure contained; Bitcoin needs a decisive push through $124k to confirm a breakout, otherwise risks consolidating back toward $117k–$114k as liquidity and the dollar dictate.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back