General Outlook

The past week was shaped by Jerome Powell’s Jackson Hole remarks, which tilted dovish and sparked expectations of a September rate cut. The dollar index weakened toward the 98.2–98.7 range, while euro, gold and bitcoin all gained ground. Looking ahead to August 25–29, traders will continue to focus on Fed communication and key U.S. data. If rate-cut expectations stay alive, euro, gold and bitcoin could extend their strength; but any surprises in inflation or employment figures could support a dollar rebound.

EUR/USD

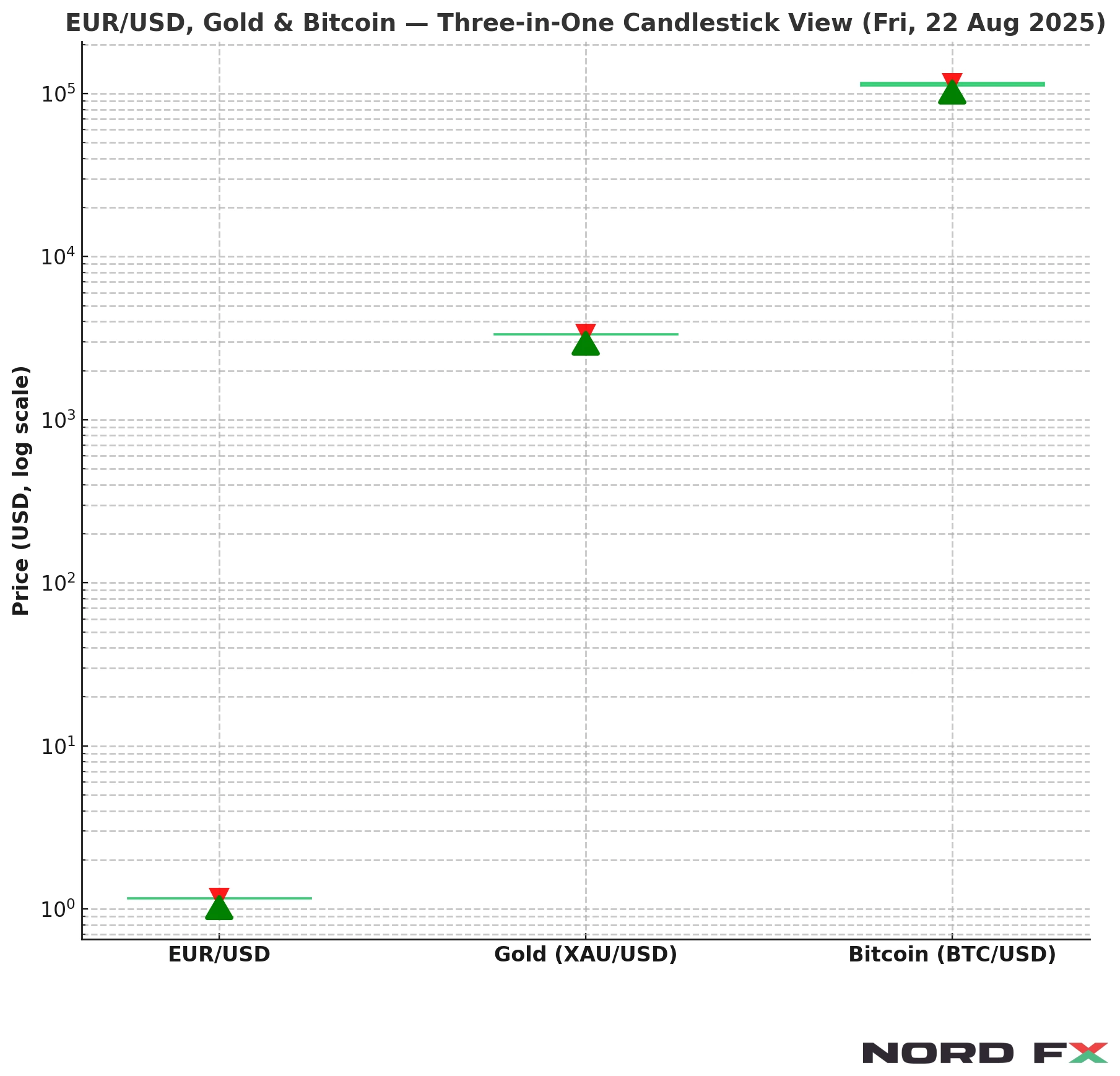

The pair closed the week near 1.1720, at the top of its recent range. Immediate resistance lies at 1.1750, and a break above could open the way toward 1.1800–1.1850. Stronger dollar demand, however, could trigger a pullback toward 1.1640–1.1600, with deeper support near 1.1550. A sustained break under 1.1550 would negate the bullish tone and suggest a broader correction. For now, sentiment remains cautiously tilted to the upside.

XAU/USD (Gold)

Gold ended Friday at about $3,371 per ounce, maintaining its powerful uptrend. Near-term resistance is seen around $3,400–3,420; a breakout could accelerate the move toward $3,480–3,500. Initial support sits near $3,330, with stronger levels at $3,300 and $3,250. A decisive break below $3,250 would undermine the bullish structure, but momentum currently favours continued tests of higher levels.

BTC/USD

Bitcoin is trading near $116,800 today, after hitting highs of $117,500 this week. Immediate resistance lies at $117,500–118,000, and a clear move above could push BTC toward the $120,000–125,000 zone. Initial support is seen at $115,000–113,500. A failure there could deepen the correction toward $110,000, but the prevailing trend remains bullish, with traders eyeing the $120k handle as the next major milestone.

Conclusion

With the Fed leaning dovish, euro, gold and bitcoin all ended the week on a strong note. EUR/USD is eyeing a test of 1.1750–1.1800, gold looks poised to challenge $3,400+, and bitcoin is pressing toward $118,000–120,000. Yet traders should be prepared for volatility, as any hawkish shift in tone or stronger-than-expected U.S. data could quickly strengthen the dollar and trigger corrections across all three markets.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.