General outlook

Last week saw a continuation of bullish momentum in major markets. The euro stabilised near its mid‑Q3 highs, the dollar remained under moderate pressure from global trade tensions, gold advanced amid safe‑haven inflows, and bitcoin surged to record levels, propelled by accelerating ETF inflows and macroeconomic optimism. The upcoming week may balance profit‑taking with further upside, especially if central bank cues and trade talks maintain their current tone.

EUR/USD

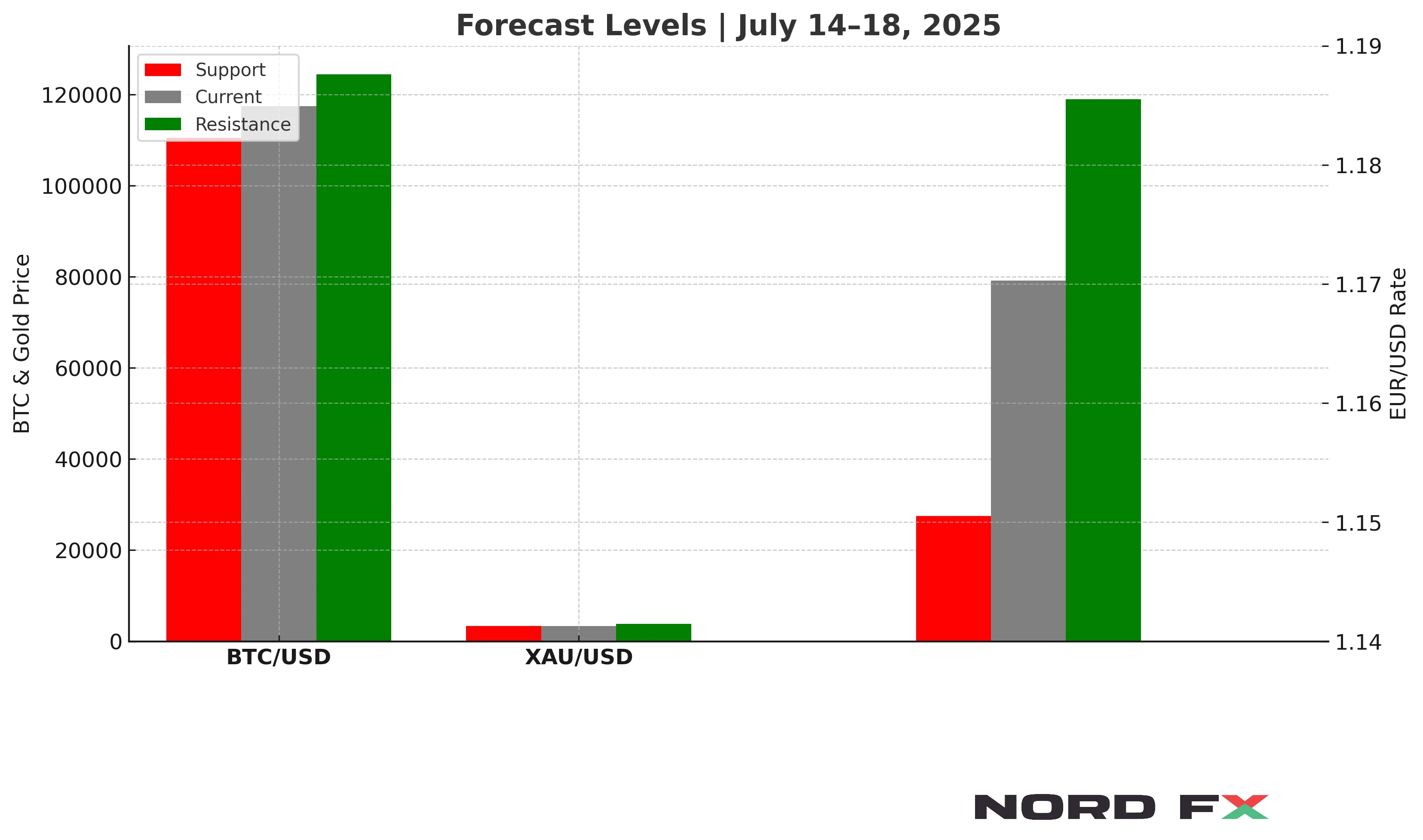

The euro closed the week trading around 1.1689–1.1703, after dipping slightly on trade‑war rhetoric before recovering. Moving averages remain bullish and the pair has held above recent support. We anticipate the euro to attempt a correction upwards, possibly testing resistance around 1.1855. A firm break and close beyond 1.2045 would invalidate a short‑term pullback scenario and could open the way toward the mid‑1.2300s. Conversely, a drop beneath 1.1505 would confirm a reversal pattern and likely initiate a deeper correction, potentially heading toward the low‑1.1400s or below.

XAU/USD (Gold)

Gold futures ended Friday around $3,355–$3,358 per ounce. The metal is trading inside a bullish formation, supported by elevated safe‑haven demand amid geopolitical and trade‑war concerns. We expect an initial pull‑back toward the $3,315–$3,330 area before prices rebound, targeting a potential breakout above $3,845 if momentum builds. Should gold dip decisively below $3,135, this would lift selling pressure, making a retest of the $2,955 mark more likely. A decisive close above $3,505 would signal continuation of the bullish triangle pattern.

BTC/USD

Bitcoin soared to a new all‑time high, reaching intraday $118,861 on Friday and closing around $117,500–$117,700. The rally is supported by surging ETF flows, institutional adoption and fading trade‑war fears. The short‑term outlook suggests a pull‑back toward $110,500–$112,000, offering a fresh springboard for renewed upside aimed at $134,500–$150,500. A decisive break below $97,505 would undermine the bullish thesis, guiding prices toward the $85,065 zone. Above $124,505, bitcoin is likely to accelerate further into uncharted territory.

Conclusion

As we approach July 14–18, markets continue to reflect the dual influence of macroeconomic concerns and strong risk‑asset sentiment. EUR/USD appears poised for a measured bounce, gold remains elevated with room to extend gains, and bitcoin has broken into fresh highs with bullish momentum intact. The week ahead will be shaped by key economic releases, central bank commentary and developments on the trade‑front. Keep an eye on technical thresholds—especially bitcoin’s $124,505 and euro’s $1.2045—to signal whether bullish trends are set to continue or if deeper pull‑backs are imminent.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back