The financial markets enter the week of November 18–22, 2024, amid significant economic and political developments shaping currency, commodity, and cryptocurrency movements. The recent re-election of Donald Trump has boosted market confidence in a pro-business and deregulation-focused administration, strengthening the US dollar. This has been further supported by robust US economic data, including low unemployment and resilient consumer spending, which reinforce expectations of continued monetary policy tightening by the Federal Reserve.

Globally, the eurozone remains under pressure due to sluggish growth and political uncertainties, which weigh on the euro. Gold prices are responding to the dollar’s strength, as investors weigh the prospects of higher interest rates against the metal's role as a safe-haven asset. Meanwhile, bitcoin is seeing record highs, driven by optimism about regulatory clarity and increased institutional adoption. These factors will be key drivers of market dynamics for EUR/USD, XAU/USD, and BTC/USD in the upcoming week.

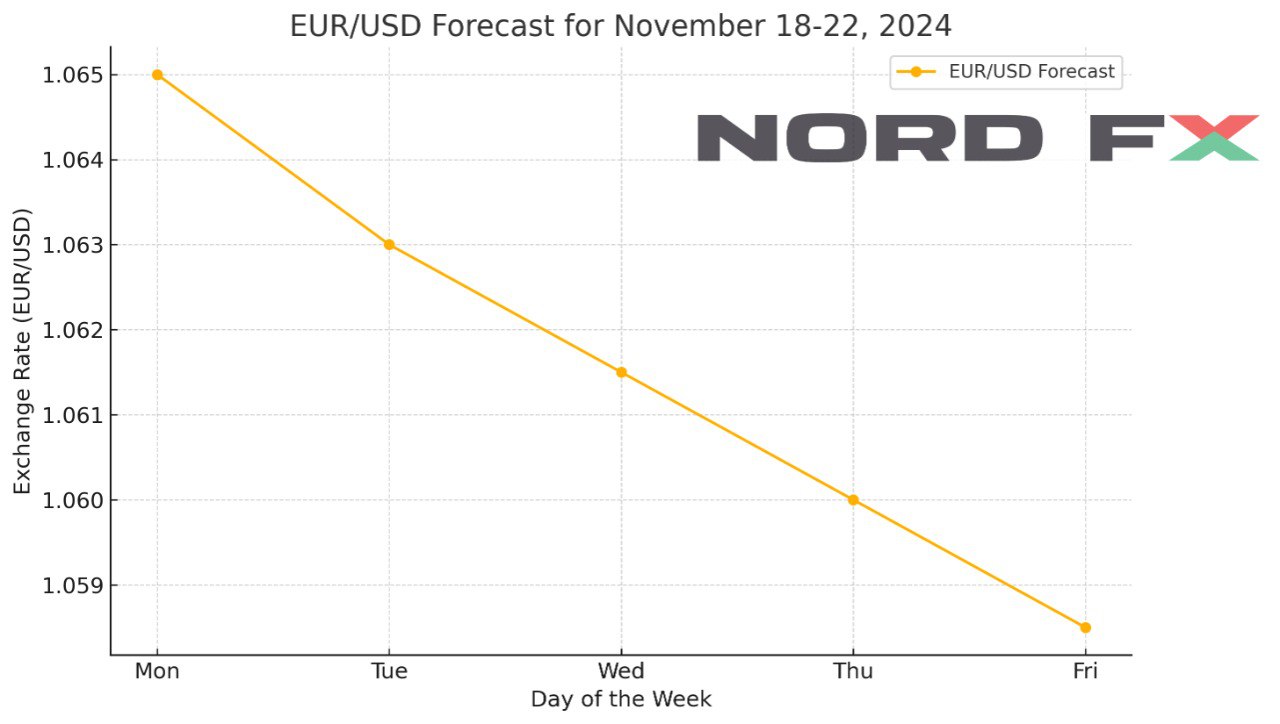

EUR/USD

The EUR/USD pair is expected to test the support area near 1.0450, with a potential rebound signalling further growth towards the target level of 1.0875. An additional signal supporting this bullish scenario is a test of the support line on the RSI indicator.

The key level to watch for invalidating this growth outlook is 1.0365. A breakout below this level would indicate further bearish momentum, with the pair likely continuing to decline towards the target of 0.9945. Conversely, confirmation of sustained growth would require a breakout above the 1.0665 level, signalling a breach of the descending channel and opening the path for further upward movement.

This outlook considers the interplay of technical signals and critical support and resistance levels, which traders should monitor closely in the coming week.

XAU/USD

Gold ended the week near 2568, with XAU/USD moving within a bullish channel. Moving averages suggest a bullish trend, with prices testing key signal lines, indicating buyer pressure and potential growth. A decline towards the 2455 support level is expected, followed by a rebound targeting 2675.

A rebound from the RSI support line and the lower border of the bullish channel supports the growth scenario. However, a breakout below 2385 would invalidate this outlook, signalling a decline towards 2315. Confirmation of continued growth would require a breakout above 2625, indicating further bullish momentum.

BTC/USD

Bitcoin (BTC/USD) closed the week at 89,337, moving within a bullish channel that suggests a continued upward trend. The moving averages and recent upward breakout through signal lines support this bullish momentum. However, a short-term correction towards the 76,505 support level is possible, from which a rebound could lead to further gains, targeting levels above 112,605.

Key signals for the week include a bounce from the bullish channel’s lower boundary and the RSI support line. A drop below 73,605 would invalidate the bullish outlook, potentially leading to a decline towards 65,605. Conversely, a breakout above 99,905 would confirm further upward movement in line with the channel’s width.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.