The final week of May concluded with relative stability across major financial instruments, though traders remained cautious ahead of the new month. The euro edged slightly lower against the US dollar, gold remained under modest pressure despite overall bullish sentiment, and bitcoin closed the week with a rebound, maintaining its position within an upward channel. As we enter the first week of June, markets will likely respond to the next wave of macroeconomic data, including inflation readings, central bank commentary, and employment statistics from both the US and Europe.

EUR/USD

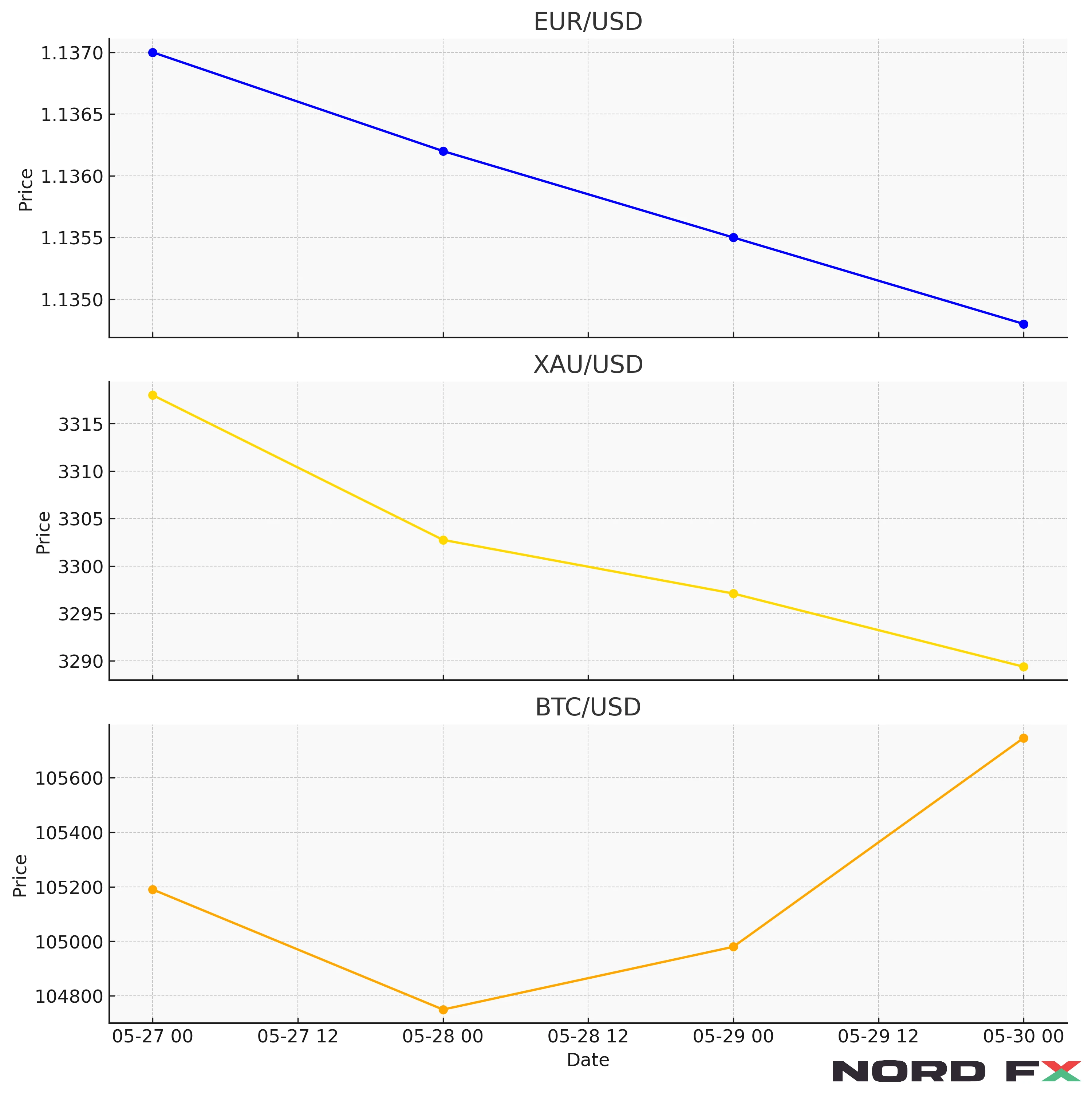

The EUR/USD pair closed the week at 1.1348, reflecting continued bearish pressure despite some intraday attempts at recovery. The pair remains below key resistance, although it has breached the signal-line zone, suggesting possible short-term upside. A test of the resistance area near 1.1525 is likely in the coming sessions. If the euro fails to overcome this level, a downward reversal may follow, targeting the support zone below 1.1105 and possibly heading further toward 1.0765. Technical indicators also suggest the possibility of a rejection from the upper boundary of a “double top” reversal pattern. A confirmed break above 1.1825, however, would invalidate this bearish scenario and open the way to continued gains toward 1.2185.

XAU/USD

Gold ended the week at $3,289.39 per ounce, slightly correcting from recent highs but maintaining its longer-term bullish trend. The metal is currently trading within a corrective structure and below key resistance, with the price still supported by moving averages. A test of the support zone near $3,195 is anticipated early in the week. Should a rebound occur from this level, the rally may continue with potential to reach above $3,405 and even extend toward $3,745. However, a sustained drop below $3,045 would signal a break from the upward channel, likely pushing prices down toward $2,785. Momentum on the RSI may offer early clues about whether gold maintains its upward structure or starts forming a deeper retracement.

BTC/USD

Bitcoin finished the week at $105,745.40, recovering modestly and remaining within the broader bullish channel. Technical indicators still favour further growth, although a brief pullback toward support near $100,565 is possible before any meaningful breakout. If buyers manage to defend that level, bitcoin may resume its rally with a projected target above $117,565 and potentially up to $143,505. Signals in favour of this scenario include a bounce from the RSI trendline and continued interest near the lower boundary of the bull channel. If bearish momentum returns and price breaks below $88,605, this would invalidate the bullish outlook and pave the way for deeper losses toward $78,505.

Conclusion

The start of June may bring increased volatility across major currency and crypto markets. EUR/USD remains under pressure unless it breaks above key resistance. Gold retains long-term bullish potential but may see short-term corrections. Bitcoin appears resilient but faces critical levels that will determine whether the rally continues. As always, traders should monitor price behaviour near support and resistance zones and remain alert to major news releases that could shift market sentiment.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.