EUR/USD: "Black Monday" Following "Grey Friday"

● The past week did not begin on Monday as usual but rather on... Friday. More precisely, the key event that shaped the dynamics of the dollar was the release of US labour market data on Friday, 2 August, which caused turmoil in the markets. The US Bureau of Labour Statistics (BLS) report showed that the number of non-farm payrolls (NFP) increased by only 114K in July, significantly lower than both the June figure of 179K and the forecast of 176K. Additionally, it was revealed that the unemployment rate has been rising for the fourth consecutive month, reaching 4.3%.

These disheartening figures triggered panic among investors, leading to a drop in Treasury yields and a mass sell-off of risky assets. It is worth noting that US stock indices: S&P500, Dow Jones, and Nasdaq Composite, as well as Japan's Nikkei, had already started turning south the day before, reacting to the outcomes of the Federal Reserve and Bank of Japan meetings. The BLS report was the final straw, after which fear took hold of investors, and the stock markets continued their downward spiral.

● It would seem that in such a situation, with global risk appetite declining, the dollar, as a safe-haven currency, should have strengthened. However, this did not happen. The DXY dollar index tumbled downhill along with the stock indices. Why? The markets decided that in order to save the economy from recession, the Federal Reserve would be compelled to take the most decisive steps to ease its monetary policy. Following the release of the BLS report, Bloomberg reported that the probability of a 50 basis point (bps) rate cut in September increased to 90%. As a result, the EUR/USD pair soared to 1.0926, before ending the week at 1.0910.

● But the crisis did not end there. 2 August could be termed a "Grey Friday," while Monday, 5 August, truly became a "Black Monday" for financial markets. Goldman Sachs analysts estimated the probability of a recession in the US economy within the next year at 25%, while JPMorgan went even further, projecting a 50% chance.

Fears of a US recession triggered a series of stock market declines worldwide. Japan's Nikkei 225 index plummeted by 13.47%, and South Korea's Kospi lost 8.77%. Trading on the Istanbul Stock Exchange in Turkey was halted shortly after opening on Monday due to the BIST-100 index dropping by 6.72%. The European stock market also opened lower. The pan-European STOXX 600 index fell by 3.1%, reaching its lowest level since 13 February. London's FTSE 100 index dropped by more than 1.9%, hitting its lowest point since April.

Following the sharp declines in Asian and European markets, US stock indices also plunged. At the start of Monday's trading, the Nasdaq Composite index fell by more than 4.0%, the S&P 500 by more than 3.0%, and the Dow Jones index dropped by approximately 2.6%. As for the dollar, the DXY hit a bottom at 102.16, while the EUR/USD pair recorded a local high at 1.1008.

● The situation gradually began to stabilize in the second half of Monday. Taking advantage of the significant drop in prices, investors started buying up stocks, and the dollar also began to recover. In general, what started with the labour market ended with it as well. Most likely, the problems in this sector were caused by temporary layoffs due to the aftermath of the devastating Hurricane Beryl, which hit, among other places, the US Gulf Coast at the end of June and the beginning of July 2024. Therefore, fresh data showing a sharp decline in unemployment claims in Texas reassured investors. Overall, the figure, published on 8 August, came in at 233K, which is lower than both the previous value of 250K and the forecast of 241K.

It seems that any talk of a recession is now off the table. As a result, the probability of a 50 bps rate cut at the September Federal Reserve meeting dropped from 90% to 56%. Moreover, while on Monday, the market's expectations for rate cuts by the end of 2024 were nearly 150 bps, they later fell below 100 bps.

● In summarising "Grey Friday" and "Black Monday," it should be noted that although the EUR/USD pair responded to the events of these days with increased volatility, its dynamics cannot be described as unique. Initially, the pair surged by 200 points, then retraced almost half of that move, and ended the past week at the 1.0915 level.

As of the evening of 9 August, 50% of surveyed analysts expect that the dollar will continue to recover its positions in the near future, and the pair will head south. 20% of analysts voted for the pair's growth, while the remaining 30% took a neutral stance. In technical analysis, 90% of trend indicators on D1 point north, with 10% pointing south. Among the oscillators, 90% are also coloured green (15% are in the overbought zone), with the remaining 10% in a neutral grey.

The nearest support for the pair is located in the 1.0880-1.0895 zone, followed by 1.0825, 1.0775-1.0805, 1.0725, 1.0665-1.0680, 1.0600-1.0620, 1.0565, 1.0495-1.0515, and 1.0450, with the final support zone at 1.0370. Resistance zones are located around 1.0935-1.0950, 1.0990-1.1010, 1.1100-1.1140, and 1.1240-1.1275.

● The upcoming week will bring a considerable amount of macroeconomic data that could significantly influence market participants' sentiments. On Tuesday, 13 August, the US Producer Price Index (PPI) will be released. Wednesday, 14 August, will bring revised GDP data for the Eurozone. Additionally, high volatility can be expected on this day as the crucial inflation indicator, the US Consumer Price Index (CPI), will be announced. On 15 August, data on retail sales in the US market will be released. Also, Thursday will see the traditional publication of statistics on the number of initial jobless claims in the United States. Given the reasons mentioned above, this figure is likely to draw increased attention from investors. The week will conclude with the release of the University of Michigan's US Consumer Sentiment Index, which will be announced on 16 August.

GBP/USD: Will It Rise to 1.3000?

● Unlike the EUR/USD pair, and despite the events of 2-5 August, the GBP/USD pair even managed to dip to a five-week low of 1.2664 on 8 August. Over the course of the recent bearish rally, the pound lost nearly 380 points against the dollar. The pair was pushed to its local bottom by the Bank of England's (BoE) decision to cut the interest rate to 5.0%, as well as the US unemployment statistics released on 8 August.

However, the dollar later retreated slightly as risk appetite returned to the financial markets. The major Wall Street indices showed significant growth, with the Nasdaq Composite leading the way, rising by 3%. The pound also found some local support from UK statistics. Retail sales volume, reported by the British Retail Consortium (BRC), grew by 0.3% in July after a -0.5% decline the previous month. Additionally, the UK Construction PMI rose from 52.5 to 55.3 points, marking the fastest growth rate in the past two years.

● According to several experts, much (if not all) of the GBP/USD pair's behaviour will depend on the pace at which the Federal Reserve and the Bank of England (BoE) ease their monetary policies. If the interest rate in the US is reduced aggressively while the Bank of England delays similar measures until the end of 2024, the bulls on the pound may have a strong opportunity to attempt to push the pair towards the 1.3000 level.

● For now, the GBP/USD pair ended the past week at the 1.2757 level. When looking at the forecasts for the coming days, 70% of experts expect the dollar to strengthen and the pair to decline, while the remaining 30% have maintained a neutral stance. As for technical analysis on the D1 timeframe, 50% of trend indicators are coloured green, and the same percentage are red. Among the oscillators, none are in the green, 10% have taken a neutral grey stance, and 90% are in the red, with 15% of them signalling oversold conditions.

In the event of a decline, the pair will encounter support levels and zones at 1.2655-1.2685, followed by 1.2610-1.2620, 1.2500-1.2550, 1.2445-1.2465, 1.2405, and finally, 1.2300-1.2330. If the pair rises, it will face resistance at the levels of 1.2805, then 1.2855-1.2865, 1.2925-1.2940, 1.3000-1.3040, and 1.3100-1.3140.

● Regarding economic statistics from the United Kingdom, the upcoming week will see the release of a comprehensive set of labour market data on Tuesday, 13 August. The following day, consumer inflation (CPI) data will be published. On Thursday, 15 August, the GDP figures will be released, and on Friday, 16 August, statistics on retail sales in the UK consumer market will be announced.

USD/JPY: No Rate Hike for Now

● Reflecting on the events of "Black Monday," it's important to note that the Nikkei, the key index of the Tokyo Stock Exchange representing the stock prices of 225 leading Japanese companies, experienced a record drop on that day, losing 13.47% and falling to a seven-month low. Such a sharp decline hadn't been seen since the "Black Monday" of 1987 and the financial crisis of 2011. The financial sector led the downturn, with Chiba Bank shares plummeting nearly 24%. Shares of Mitsui & Co., Mizuho Financial Group, and Mitsubishi UFJ Financial Group Inc. also dropped sharply, by approximately 19%. The strengthening of the yen against the dollar (by more than 12% over the last four weeks) further pressured the Japanese stock index, as it negatively impacts the foreign exchange earnings of export-oriented companies.

However, life is like a zebra, with a white stripe usually following a black one. Less than a day after "Black Monday," the Nikkei 225 showed a historic rebound, rising by 10.12%, which was a record in the history of the Tokyo Stock Exchange.

The reaction of Japan's Finance Minister Shunichi Suzuki to the events was particularly interesting. On 8 August, he stated that he was "closely monitoring stock volatility but has no intention of taking any action." He also added that "the specifics of monetary policy depend on the Bank of Japan (BoJ)."

● It is relevant to mention the words of Shinichi Uchida, Deputy Governor of the Bank of Japan, who stated on Wednesday, 7 August, that the regulator would not raise interest rates further while financial market volatility remains high. Previously, the Bank of Japan had raised the benchmark interest rate by 0.25% for the first time since 2008. Following this decision, the yen sharply strengthened against the dollar. However, according to economists at Germany's Commerzbank, the BoJ now finds itself in a very challenging situation once again.

"One almost feels sorry for the Japanese yen," they write. After the turbulent events of recent weeks, the USD/JPY pair has stabilized around the 147.00 level. "The calm of the past few days seems more like an unstable equilibrium," Commerzbank notes. "At the moment, the exchange rate appears to have settled, but it is expected that the US will lower its key interest rates about four times by the end of the year. However, our economists still do not anticipate a recession in the US, so they continue to expect only two rate cuts."

"In this case, USD/JPY should gradually rise," conclude the German bank's economists, targeting a level of 150.00.

● The USD/JPY pair ended the past week at the 146.61 level. The expert forecast for the near term is as follows: 40% of analysts voted for the pair to move upwards, 25% expect it to decline, and the remaining 35% took a neutral stance. Among trend indicators and oscillators on the D1 timeframe, 90% indicate further decline, while 10% point to growth.

The nearest support level is located around 144.30, followed by 141.70-142.40, 140.25, 138.40-138.75, 138.05, 137.20, 135.35, 133.75, 130.65, and 129.60. The nearest resistance is in the 147.55-147.90 zone, followed by 154.65-155.20, 157.15-157.50, 158.75-159.00, 160.85, 161.80-162.00, and 162.50.

● On Thursday, 15 August, preliminary GDP data for Japan for Q2 2024 will be released. Additionally, traders should note that Monday, 12 August, is a public holiday in Japan as the country celebrates Mountain Day.

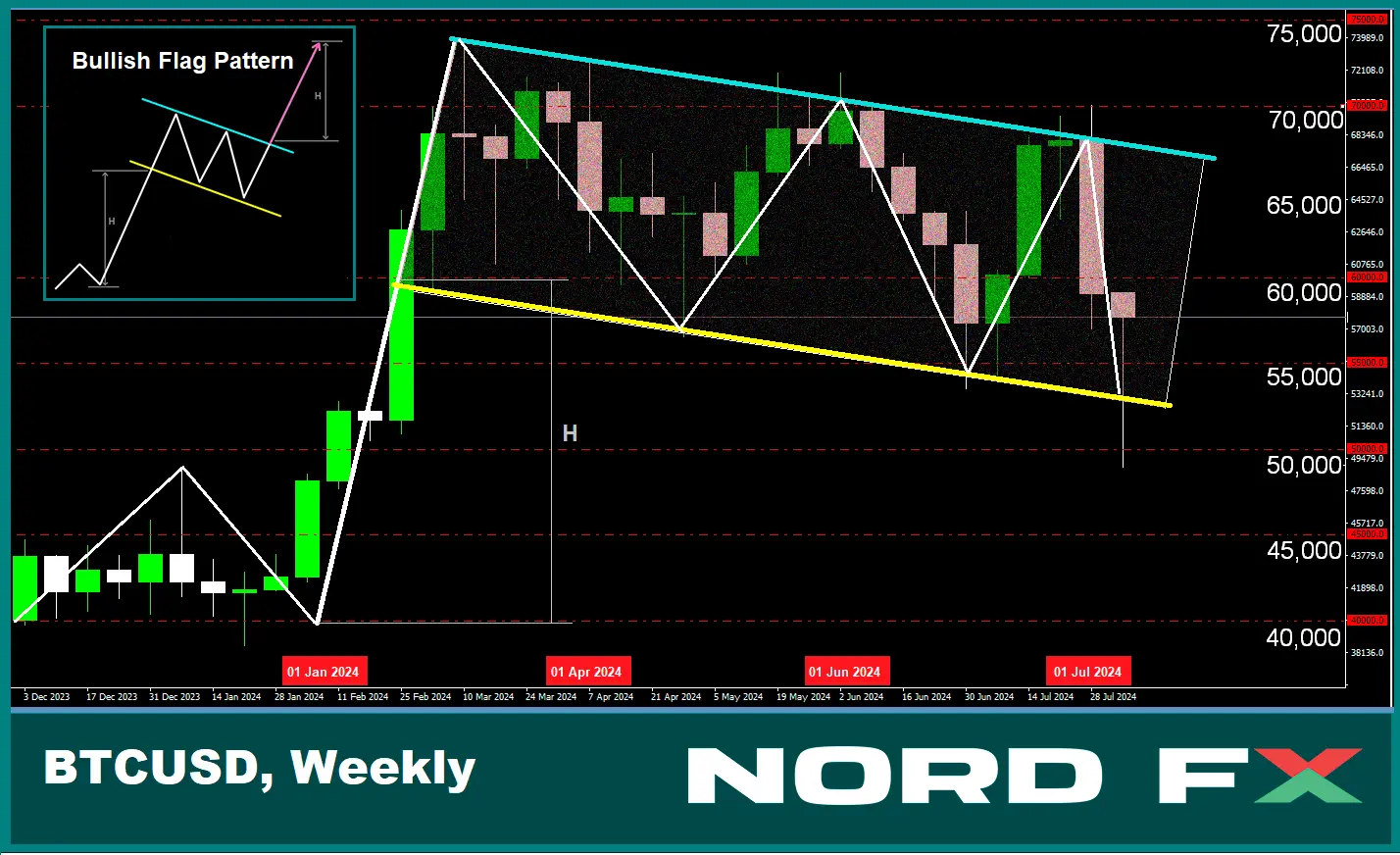

CRYPTOCURRENCIES: "Black Monday" & Bullish Flag for Bitcoin

● Another bearish cycle for bitcoin began on 29 July after the BTC/USD pair reached a high of $70,048. The leading cryptocurrency continues to face pressure from the potential sale of coins returned to creditors of the bankrupt exchange Mt. Gox, as well as assets previously confiscated by law enforcement agencies, including those in the United States.

The decline in bitcoin prices is occurring against the backdrop of investor flight from risk and a broader global stock sell-off, driven by concerns about the outlook for the global economy, particularly in countries like Japan and the United States. Negative sentiments are further exacerbated by tensions in the Middle East, uncertainty regarding the Federal Reserve's monetary policy, and the policies of the new US president, who will be elected in November.

On Friday, 2 August, bitcoin spot ETFs experienced their largest outflow of funds in the past three months. Hayden Hughes, head of cryptocurrency investments at Evergreen Growth, believes that digital assets have become casualties of the unwinding of carry trades using the Japanese yen after the Bank of Japan raised interest rates. However, a more apparent driver of the sell-off was the release of extremely disappointing US labour market data on 2 August.

These data sparked fears of a possible recession in the US, triggered a decline in Treasury yields, induced panic on Wall Street, and led to a sell-off of risk assets, including stocks and cryptocurrencies.

● On "Black Monday," 5 August, bitcoin briefly dropped to $48,945, while Ethereum fell to $2,109. This decline was the sharpest since the collapse of the FTX exchange in 2022. Nearly $1 billion in leveraged long positions were liquidated, and the overall market capitalization of the crypto market plunged by more than $400 billion since Sunday evening. It’s worth noting that the event had a more significant impact on altcoins: of the $1 billion in forced liquidations, less than 50% were attributed to bitcoin, and its market dominance increased by 1% over the week, reaching 57%.

Describing the recent events, it's also crucial to highlight that the panic was mainly confined to short-term holders (STH), who accounted for 97% of the total losses. In contrast, long-term holders (LTH) took advantage of the price drop to replenish their wallets, with their holdings (excluding ETF addresses) growing to a record 404.4K BTC.

● Analysts at Bernstein believe that bitcoin's reaction as a risky asset to broad macroeconomic and political signals is not surprising. "A similar situation occurred earlier during the sudden crash in March 2020. However, we remain calm," they explained at Bernstein. The experts noted that the launch of spot BTC-ETFs prevented the price from dropping to $45,000. This time, they predict the crypto industry's response to external factors will also be restrained. This is supported by the gradual recovery in prices starting from the second half of 5 August. It appears that the same can be said for spot Ethereum-ETFs. Their investors also became more active, taking advantage of the price drop. Over the first two days of the week, the net inflow into these funds totalled $147 million, marking the best performance since their launch.

● Analysts at Bernstein also believe that in the near term, the price of the leading cryptocurrency will be influenced by the "Trump factor." "We expect that bitcoin and cryptocurrency markets will remain in a limited range until the US elections, fluctuating in response to catalysts such as the presidential debates and the final election outcome," Bernstein experts state. However, according to Arthur Hayes, co-founder and former CEO of the cryptocurrency exchange BitMEX, "It doesn't matter who wins the presidential race: both sides will print money to cover expenses. The price of Bitcoin in this cycle will be very high, hundreds of thousands of dollars, possibly even $1 million."

● As mentioned earlier, the primary driver of the 2-5 August market crash was disappointing macroeconomic data from the United States. According to many analysts, this situation should push the Federal Reserve to begin a cycle of economic stimulus and interest rate cuts as early as September. This implies that markets are likely to see new injections of dollar liquidity in the near future. Recent turmoil in traditional markets "increases the likelihood that a less restrictive monetary policy [from the Fed] will arrive sooner rather than later, which is good for cryptocurrency," asserts Sean Farrell, Head of Digital Asset Strategy at Fundstrat Global Advisors.

● The analyst known as Rekt Capital believes that a surge in the price of bitcoin could occur as early as October. He suggests that the current chart is forming a bullish flag, which inspires optimism. "While bitcoin shows the potential for a downward deviation in the near future, the leading cryptocurrency is slowly approaching its historical breakout point around 150-160 days after the halving," notes Rekt Capital. However, he cautions that although a price breakout is expected, it is unlikely that bitcoin will reach a new all-time high, as seen in March, in the medium term. The expert also emphasized that the current state of the crypto market suggests that BTC is unlikely to drop to $42,000, as buyers are showing strong support for the asset.

● Renowned analyst and trader Peter Brandt, head of Factor LLC, has noted that the recent market crash has created a situation similar to what was observed in 2016. Eight years ago, bitcoin dropped by 27% following the halving in July, and this year, the coin's price has fallen by 26%.

After hitting a bottom at $465 in August 2016, bitcoin's price surged by 144% by early January 2017. Drawing a parallel between these trends, Brandt suggests that an upward trend may soon emerge, potentially leading BTC to a new all-time high (ATH) by early October. If digital gold increases by the same magnitude as in 2016, its price would reach $119,682.

However, there are also more pessimistic views. For instance, Benjamin Cowen, founder of the blockchain project ITC Crypto, believes that bitcoin's price dynamics may follow a pattern similar to 2019, where the coin appreciated in the first half of the year and depreciated in the second. In this scenario, the downward trend would continue, and BTC could see new lows.

● If the leading cryptocurrency lost 21% of its value from Saturday to Monday (3-5 August), the main altcoin, Ethereum, dropped by 30%. QCP Group is confident that this was linked to the sale of Ethereum by Jump Trading. According to their information, Jump Trading unlocked 120,000 wETH tokens on Sunday, 4 August. Most of these tokens were sold on 5 August, which negatively impacted the price of Ethereum and other assets. QCP Group speculates that the market maker either needed liquidity urgently due to margin calls in the traditional market or decided to exit the market entirely for reasons related to LUNA tokens.

For reference, on 21 June 2024, the US Commodity Futures Trading Commission (CFTC) began investigating Jump Trading's activities, as the company acquired LUNA tokens at 99.9% below market value, and the subsequent sale of these tokens caused a collapse in the asset's price.

● As of the evening of Friday, 9 August, the BTC/USD pair has recovered a significant portion of its losses and is trading at the $60,650 level. Ethereum, however, has not fared as well, with the pair managing to rise only to the $2,590 zone. The total market capitalization of the crypto market stands at $2.11 trillion (down from $2.22 trillion a week ago). The Crypto Fear & Greed Index initially plummeted from 57 to 20 points, dropping from the Greed zone straight into the Extreme Fear zone, but it has since risen to 48 points, reaching the Neutral zone.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Go Back Go Back