The past week saw significant developments across Forex and cryptocurrency markets, characterised by ongoing corrections and trends shaped by key technical levels. EUR/USD continued its decline within a descending channel, while bitcoin maintained its position in a bullish channel despite some corrective movements. Gold prices demonstrated resilience, sustaining growth within an ascending channel. As we move into the final trading week of December, market participants should prepare for possible rebounds from key support levels, signalling potential opportunities for growth across these assets.

EUR/USD

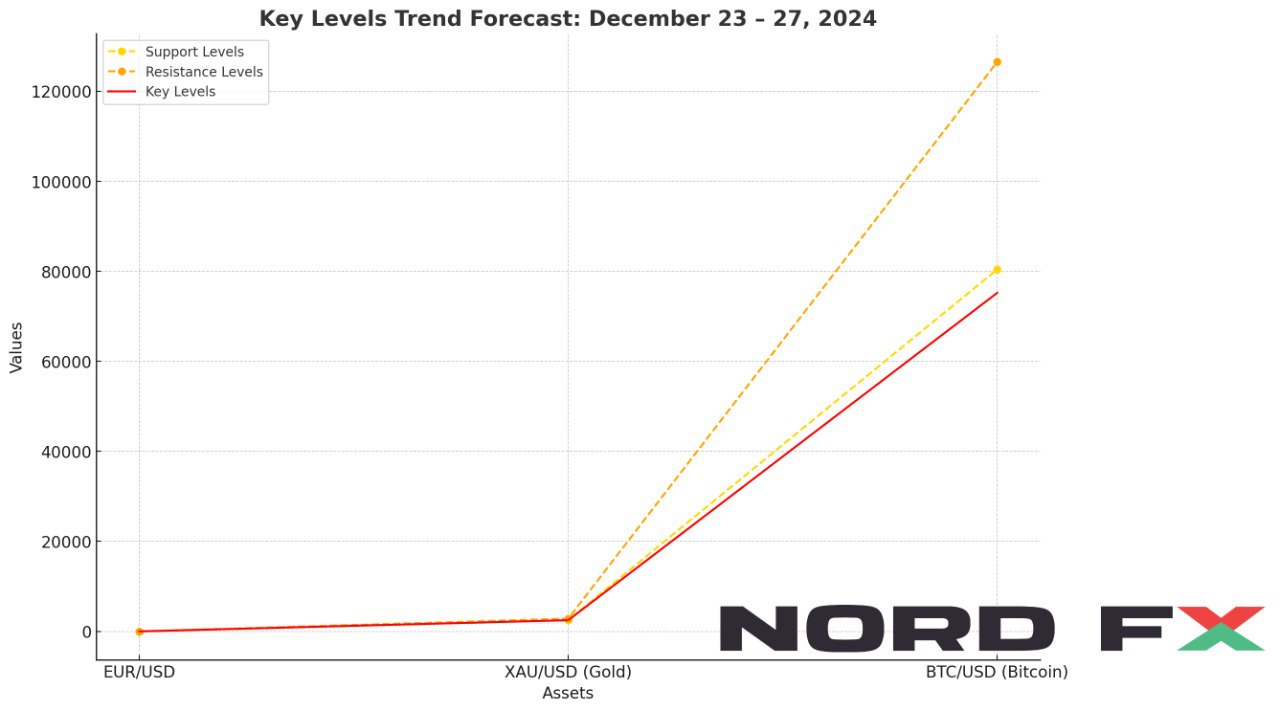

The EUR/USD currency pair concluded the previous week near the 1.0401 mark, continuing its downward movement within a defined descending channel. The pair's bearish trend remains evident, supported by downward-moving averages and a break below the signal lines. In the upcoming week, further testing of the support area near 1.0345 is anticipated, potentially followed by a rebound. This rebound may drive the pair towards the target zone above 1.0705.

An additional indicator of upward momentum would be a test of the support line on the relative strength index (RSI). However, should the pair break below 1.0195, the bearish scenario could extend, potentially targeting levels near 0.9805. Confirmation of growth would come with a close above 1.0585, suggesting a breakout from the descending channel.

XAU/USD

Gold ended the previous week at 2627, maintaining its bullish trajectory within an ascending channel. Moving averages continue to favour buyers, reinforcing the trend. In the coming week, a test of the support level near 2525 is likely, with the potential for a rebound driving prices higher towards 2845.

Additional signals supporting further growth include a rebound from the RSI trend line and the lower boundary of a "Triangle" pattern. A breakdown below 2495, however, would invalidate the bullish outlook, signalling a potential decline to levels near 2425. Conversely, a close above 2705 would confirm the continuation of the upward trend and validate the pattern's potential target at the upper range.

BTC/USD

Bitcoin closed the past week at 97154, navigating within a bullish channel despite corrective price action. Moving averages indicate continued upward pressure, with a possible test of the support level near 80405 in the coming week. A rebound from this level could push bitcoin towards the upper target of 126505.

Support for the bullish scenario includes a rebound from the lower boundary of the channel and the RSI support line. However, a breakdown below 75205 would negate the bullish outlook, opening the door for further declines to 66505. On the upside, a breakout above 102665 would confirm renewed bullish momentum, signalling further potential for growth.

The final trading week of December promises continued activity across Forex and cryptocurrency markets. EUR/USD may see a critical test of support, with potential for rebounds shaping its near-term trajectory. Gold prices are set to maintain their bullish path, provided key support levels hold firm. Bitcoin's bullish channel remains intact, though it must withstand a possible test of lower levels to sustain growth. Traders should remain vigilant and watch for breakouts or rebounds that could signal decisive moves as the year comes to a close.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.