General Outlook

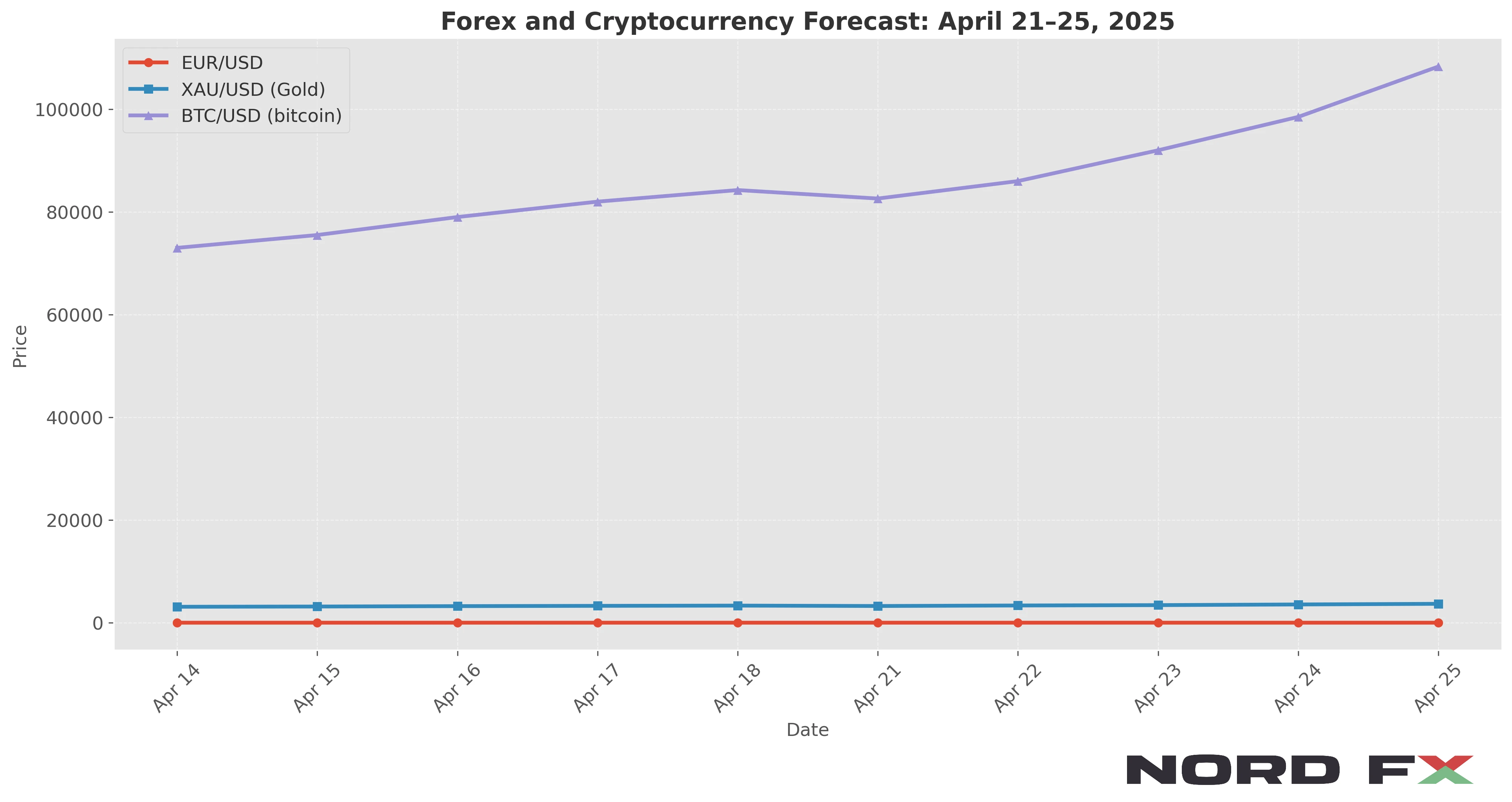

The previous trading week closed on a broadly bullish note for several major assets. The euro, bitcoin, and gold all showed strong growth, largely supported by buying pressure and technical breakouts from key levels. Despite these upward moves, the potential for short-term corrections remains, as markets may look to retest recently broken support zones before resuming their upward trends. In the coming week, we anticipate a cautious start with probable pullbacks, followed by renewed bullish momentum, provided key support levels hold.

EUR/USD

The EUR/USD pair ended the previous week with significant gains, reaching the 1.1388 area. Despite this upward movement, technical indicators still point to a prevailing bearish trend, with moving averages suggesting caution. However, the recent break above the area between the signal lines reflects strong buying interest and a possible continuation of growth.

In the week ahead, we expect a bearish correction towards the 1.1185 support level. If this level holds, a rebound is likely, potentially pushing the pair back up towards the 1.1935 mark. A key signal in favour of a bullish continuation is the test of the support line on the RSI, as well as a rebound from the previously broken upper boundary of the bearish channel.

Should the pair fall and break through 1.0995, the bullish outlook would be cancelled, and further declines towards 1.0635 could be expected. Conversely, a confident close above 1.1485 would confirm the upward scenario.

XAU/USD (Gold)

Gold prices closed last week with aggressive growth near the 3327 level, maintaining their position within a bullish channel. The breakout above the signal lines further supports the current upward trend.

During the upcoming trading week, we anticipate a short-term correction towards the 3205 support zone. If buyers hold this level, gold is likely to resume its climb, targeting the 3675 level. Supporting this scenario is the RSI, which indicates a bounce from the trend line, along with a potential rebound from the lower boundary of the bullish channel.

If, however, the price drops below 3165, it would suggest a breakout from the channel and could trigger a deeper correction, with a likely target near the 2785 mark. A breakout above the 3385 resistance level would confirm continued upward momentum.

BTC/USD (bitcoin)

Bitcoin finished the week at 84,255 and remains within a bullish channel, despite the development of a corrective phase. The coin continues to receive support from the moving averages, which underline a long-term uptrend. Price action around the signal lines suggests that buying interest is still present.

In the short term, we expect a decline to the support level at 82,605. If this area proves resilient, a renewed upward move towards the 108,305 level may follow. The RSI also signals support, and a rebound from the lower boundary of the bullish channel adds further weight to the bullish case.

Should the price fall below 72,305, however, this would invalidate the current growth scenario and point to a deeper decline, possibly reaching 64,505. Confirmation of bullish continuation would come with a breakout above 98,505, signalling a breach of the upper boundary of the corrective channel.

Conclusion

Overall, despite short-term correction risks across EUR/USD, XAU/USD, and BTC/USD, the medium-term outlook remains cautiously optimistic. Buyers are still active, and unless key support levels are breached, the broader bullish trend could resume across all three instruments. Careful monitoring of these support and resistance zones will be crucial for traders navigating the upcoming week.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.