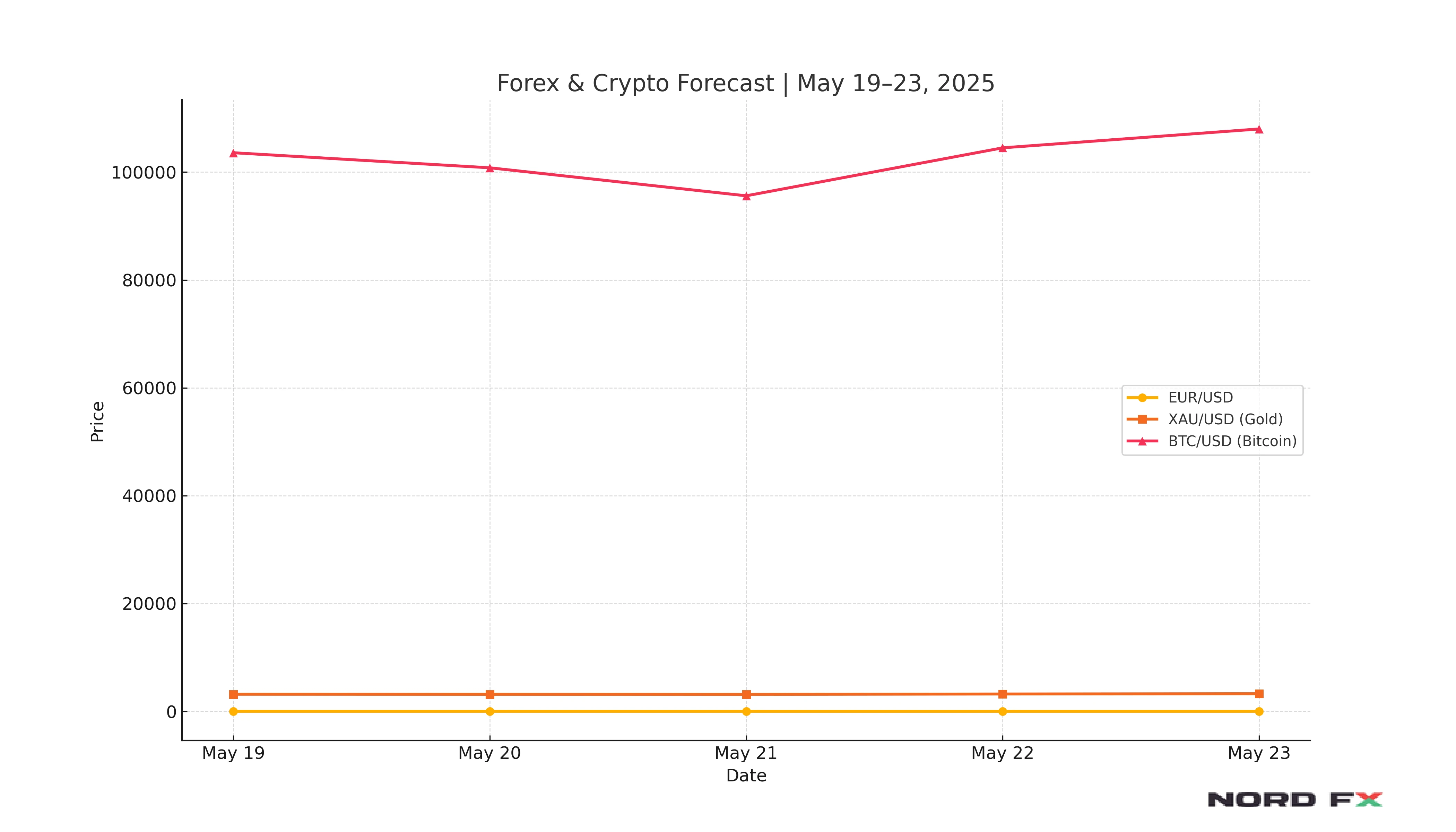

General Market Overview

As of Friday afternoon, global financial markets remain in a state of cautious anticipation. Currency and commodity pairs are moving within key technical boundaries, while bitcoin continues to show signs of strength despite short-term pullbacks. Market participants are closely watching macroeconomic signals and technical levels to determine direction for the upcoming week.

EUR/USD

The EUR/USD pair is trading near 1.1203, maintaining a modest downward trajectory after attempts to correct earlier losses. Despite bearish sentiment dominating the longer-term trend, recent movements suggest a possible short-term rise toward resistance around 1.1305. However, any gains are likely to remain limited, with sellers expected to re-enter the market near that zone.

If the pair fails to break above this resistance, it may retreat toward the support area below 1.0765. Confirmation of the bearish scenario could come from a bounce off the lower boundary of the ascending channel and a retest of the broken RSI trend line. A strong move above 1.1705 would invalidate the current downward outlook and signal a possible continuation towards 1.1985. A close below 1.1045 would reinforce downside pressure.

XAU/USD (Gold)

Gold is currently fluctuating around 3,170 after a moderate correction from recent highs. While the broader trend remains upward, the metal is consolidating within a tightening range. Technical support is forming near 3,145, where renewed buying interest may emerge. If gold rebounds from this level, a rise toward the 3,545 resistance zone is likely.

Bullish confirmation would come from a reaction at the RSI trend line and a rebound from the lower boundary of the upward channel. A break below 2,965 would invalidate this scenario and indicate a potential decline toward 2,775. On the upside, a sustained breakout above 3,345 would reinforce bullish momentum.

BTC/USD (Bitcoin)

Bitcoin is holding steady around 103,600, preserving its position within an ascending price channel. The broader trend remains bullish, supported by strong buying activity earlier in the week. However, a short-term correction remains possible, with key support seen near 95,600. A rebound from this zone could trigger another leg up towards the 127,600 region.

Technical signals favour continued growth, including a bounce from the RSI trend line and a reaction at the top of the descending correction zone. A decline below 88,400 would negate the bullish outlook and open the door to further losses toward 75,665. Conversely, a close above 108,665 would reaffirm the upward trend.

Conclusion

Heading into the week of May 19–23, traders should remain alert to potential breakouts and reversals across major instruments. EUR/USD may attempt a brief rebound before resuming its decline, while gold continues to consolidate ahead of its next move. Bitcoin remains the most bullish of the three, although a brief correction cannot be ruled out. Key support and resistance levels will likely shape price action across all assets.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.