First, a review of last week’s forecast:

- 60% of analysts, supported by graphical analysis on D1, 100% of trend indicators and 85% of oscillators on H4, expected the EUR/USD to grow, and this forecast turned out to be correct. The pair coped with the task quickly and, having risen by 125 points on Tuesday, reached the height of 1.2475. After this, the trend reversed, the pair returned to the borders of the mid-term side corridor, where it has been moving for the whole of 2018, and completed the week in the zone of its Pivot Point at 1.2325;

- GBP/USD. 40% of analysts and 95% of indicators sided with the bulls last week, waiting for the continuation of the uptrend. Levels 1.4215 and 1.4275 were called as resistance levels. As for the remaining 60% of experts, they expected the pair to go down to the horizon 1.4080. As a result, both forecasts were implemented, with a certain tolerance. At first the pair climbed to 1.4243, and then turned and went south, finding the local bottom in the zone 1.4010, not far from which it finished the week, at the level 1.4015;

- even though most experts expected the medium-term downtrend to continue, one third of them, in anticipation of correction, looked north. 10% of the oscillators supported such development, giving signals that the pair was oversold. As for graphical analysis, it indicated the target - the height of 107.00, to which the pair rose on Wednesday, March 28. After that, it turned and fell to the level of 106.27 by the end of the week;

- and now, cryptocurrencies that moved all the way to the south all week, even though many oscillators insistently indicated they were oversold. Optimists call this fall a prolonged correction, pessimists talk about the beginning of the end of the crypto currency boom. Whatever it is, the fact remains - the crypto market "shrunk" by 70% during three months of 2018, and its capitalization is now only 275 billion USD.

There are several reasons for this fall: this is ongoing hacker attacks on crypto-exchanges and client wallets, more unsuccessful ICO projects, and the increased pressure on this market by regulators. The Chinese authorities made an announcement on further steps on Thursday, and in Japan, five exchanges withdrew their applications for licensing, realizing that they will not be able to meet the requirements of the FSA - Financial Services Agency of this country.

As a result, bitcoin dropped to the level of 6520, Litecoin - down to 108.00, ripple - 0.45, and the Ethereum fell to the values of last June to the zone of 365.0.

As for the forecast for the coming week, summarizing the opinions of a number of analysts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. The overwhelming majority of experts have taken a neutral position, waiting for the pair to go on moving in the mid-term lateral channel of 2018. As for trend indicators and oscillators, about 60% recommend the sale of the pair, 40% - purchase, or are painted neutral gray. The above allows us to say that the pair is likely to stay within this channel for the first half of the week. The nearest support is in the zone 1.2240, the next one is 1.2155. Resistance is at the levels is 1.2445 and 1.2535.

Higher volatility of the pair can be expected on Wednesday and Thursday after the release of data on the European consumer market and information about the ECB meeting. On Friday, the market is expecting data on the labor market from the US. One of the most important indicators here is the NFP, which determines the number of new jobs created outside the agricultural sector. According to forecasts, it may fall by about 35%, which can weaken the dollar considerably. However, data on average wages in the US will be published at the same time with the NFP, which may provide some support to the US currency. - GBP/USD. As in the case of EUR/USD, half of analysts vote for a sideways trend. As for the indicators, about 50% of them on D1 point to the east. 30% of experts, 15% of the oscillators, giving signals that the pair is oversold, and graphical analysis on H4, waiting for the pair to return to the level of 1.4245, side with the bulls. The bears this week are represented by 20% of analysts and graphical analysis on D1, expecting the fall of the pair to the corridor 1.3780-1.3875.

It should be noted that the number of bears' supporters increases to 55% in the medium term; - USD/JPY. It is impossible to use indicators at the moment - their readings are a mixture of green, red and neutral gray colors. As for the experts, 55% of them believe that the uptrend that started last week will continue, and the pair will rise to 107.30. The next target is 108.50.

The remaining 45% of analysts, supported by graphical analysis on D1, on the contrary, are confident that the pair will not be able to overcome the resistance of 107.00 and will go first to support 104.65, and then even further downwards - to zone 101.20-104.30. - The forecast for the main cryptocurrency pairs is the following.

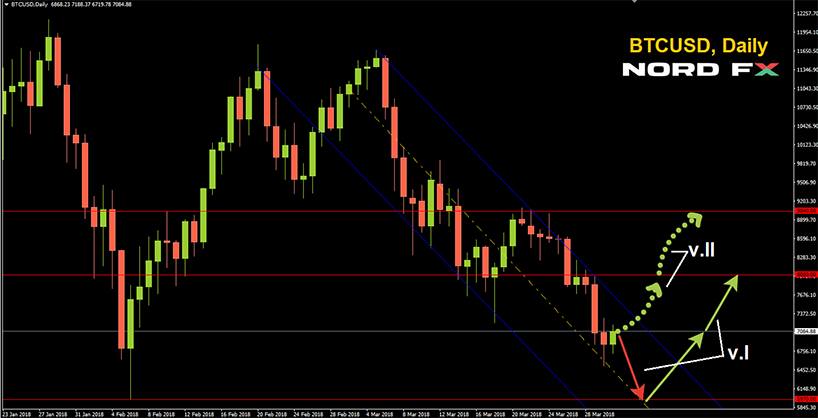

BTC/USD: experts expect the continuation of a downtrend to the horizon of 5970, and in case of its breakdown, down to 5425. After this, the trend should reverse and return to the 8000 zone, which can take two to three weeks to complete.

Similar dynamics are expected for other pairs. ETH/USD: decrease to the zone 200.00-275.00 and the subsequent retreat into the zone 500.00. LTC/USD - drop to 85.00-105.25, then rebound to 173.80. XRP/USD - according to experts, this pair can find the bottom at the level of 0.25-0.30, after which it will for some time return to the level of 0.63.

Dear traders, brokerage company NordFX offers you the opportunity to earn both on growth and on the fall of cryptocurrencies, using a leverage ratio of up to 1:1000.

Deposit and withdrawal of funds in USD, bitcoins and Ethereums.

https://nordfx.com/promo/tradecrypto.html

Roman Butko, NordFX

Go Back Go Back