The advisors of the Ilan family are probably the most famous among those based on the martingale principle and position averaging. One can freely access many different versions online; we will consider one of the most common ones as an example, namely 425_Ilan1.6_PipStep.

First, let's define what we mean by the word martingale (or martin, as traders often say). Some people think that this is the name of a person and write it with a capital letter. These people are mistaken. Martingale, according to Wikipedia, is a system of managing bets in gambling that has been known since the middle of the XVIII century. The name, perhaps, comes from the jargon of gamblers from Occitania (France), where “a la martengalo” meant "[play] in an absurd way". In turn, the word “martengalo” referred to the residents of a small town called Martigues: these residents were often represented in jokes as naive simpletons.

Initially, the martingale system was used to play in casinos and was mainly used when making evenly chanced bets on the roulette, such as odd / even, red / black. In our case, this bet becomes the choice of buy / sell.

With the probability of losing or winning both being 50%, one’s subsequent bet doubles after each loss. This continues until there is a win. Such a method allows one to recover all past losses in this series and still get winnings equal to the minimum rate.

Similarly, once we move to Forex and open an initial order sized at 0.01 lot, doubling the position (done by setting parameter LotExponent = 2 in the adviser's settings), causes the series to look like this: 0.01-0.02-0.04-0.08-0.16-0.32-0.64-1.28-2.56-5.12-10.24-20.48-40.96-81.92

As you can see, on the 14th order, the volume of your position is equal to over 8000 times the original position (we moved from 0.01 to 81.92 lots). This is overwhelmingly likely to become an unbearable load on the deposit and lead to its complete loss.

With a position equal to 1 lot, a price movement of just 1 point contrary to the trader’s position leads to a loss of $ 10. Correspondingly, if the total volume of your open positions is 100 lots, a fluctuation of just 1 point will lead not to just to a 10-dollar loss, but to a 1000 one. However, there is nothing limiting price movements to just 1 point: they can fluctuate by tens and even hundreds of points!

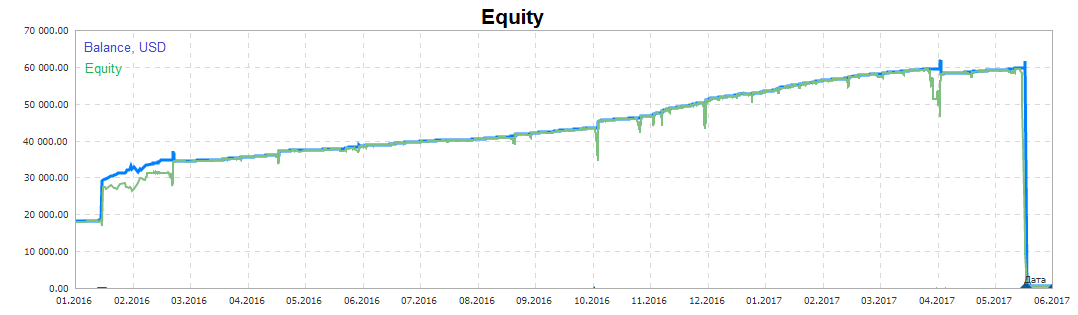

Fig. 1 is a plot of typical cases of this nature. In this example, a full "offload" of the deposit occurred following one and a half a year’s (!) worth of successful work by the adviser, which had brought a profit of 200%!

Fig. 1.

The shape of Fig. 1 is precisely the main argument of those who oppose the martingale method. In their opinion, the loss of the deposit is inevitable.

Trader Reviews:

There are, however, other reviews:

The last review very clearly shows the weak point of this adviser: a long unbending trend, during which Ilan is forced to constantly increase the volume of unprofitable position. This, in turn, leads to an avalanche-like growth of drawdown.

To avoid catastrophe and reduce risks, the adviser's settings contain the following main parameters:

1. LotExponent: a coefficient, according to which the volume of each subsequent position in the series is increased.

Above, we considered what happens if LotExponent = 2. Now, let's see what a series of the same 14 positions will be, if, for example, LotExponent = 1.3 (it should be noted that the volume of lots is rounded to 2 decimal places):

0,01-0.01-0.02-0.02-0.03-0.04-0.05-0.06-0.08-0.11-0.14-0.18-0.23-0.30

As you can see, in this case the volume of the 14th position has not even reach 1 lot, which significantly reduces the risks. But, on the other hand, to close such a series with a profit, you will need a much larger rollback of the price in the direction you need, rather than with LotExponent = 2.

2. PipStep is the stage at which every subsequent position in the series will open.

For example, if PipStep equals 10 points, the series of 14 positions will only fully open after a price change of 130 points. If on the other hand, PipStep equals to 30 points, the price it will have to move by 390 points.

3. In addition to Pipstep, the settings include a parameter called PipStepExponent.

This allows you to gradually increase (or decrease) the size of each step, thereby influencing the drawdown.

For example, if Pipstep = 10 points, and PipStepExponent = 2, the first move will be 10 points, whilst the next one is double that, i.e. 20 points, followed by 40 points and so on.

4. This Advisor uses the RSI indicator as a filter.

We would not recommend changing its settings (the default is 30/70). In other variations of Ilan, you will be able to find other indicators that can approve or block the opening of another order.

5, 6 and 7. In addition, when one fixes the settings one should also pay attention to the following parameters: TakeProfit, StartStepExp and MaxTrades, as these also significantly affect the results of the Expert Advisor.

Special attention should be granted to the last of these, as this determines the maximum number of positions in the series. However, even though reducing the number of MaxTrades does indeed lead to a decrease in the drawdown, it also threatens to make this drawdown eternal.

Results of our testing

As you can see, 425_Ilan1.6_PipStep has a large variety of settings. When combined with the large variety of currency pairs and timeframes in existence, this can make our testing process endless. That is why, the main purpose of our testing was to understand whether this particular adviser is able bring a stable profit over a long period of time, or if it will rather, as one of the traders put it, turn out to be a "rotten soup" with a fatal outcome for the deposit.

For the testing, we, as usual, chose the EUR/USD, with a starting lot of 0.01, and a testing period of just over one and a half years, from 01.01.2016. to 30.09.2017.

There is a saying that there are no big drawdowns, just small deposits. Therefore, with an increase in the deposit, the number of negative results during the examination decreased whilst positive results increased. For example, those traders whose trading account managed to withstand a drawdown of $ 26,309 were able to receive a more-than-handsome profit of $ 153,368.

Our testing, however, was primarily aimed to inform the average trader with an average deposit. Profitable courses of events still exist in this case, and there are many of them.

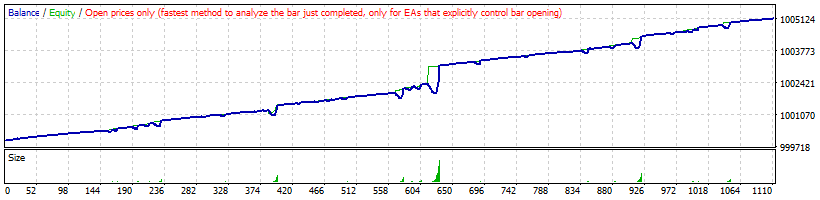

The best results that were achieved at the one-minute interval M1: a profit of $ 5.155, with a maximum drawdown of $ 1.264, a total number of transactions 1109, a maximum position volume 0.87 lots, and a total position volume of 3.7 lots (Fig.2).

Settings: LotExponent = 1.3; TakeProfit = 22; PipStep = 30; PipStepExponent = 0.8; StartStepExp = 7; RsiMinimum = 30; RsiMaximum = 70; MaxTrades = 20;

Fig. 2.

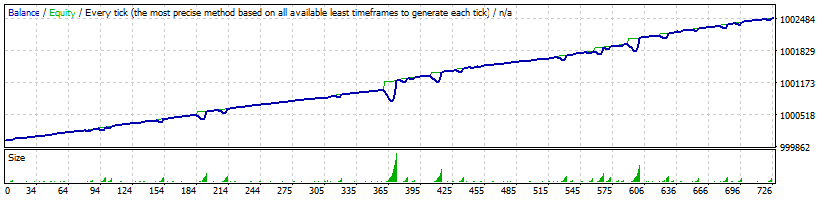

Equally effective under the same settings was trading on the H1 interval. The results were as follows: a profit of $ 2.497, a maximum drawdown of $ 646, a total number of transactions of 725, a maximum position volume of 0.23 lot, and a total volume of 0.98 lot (Fig. 3).

Fig. 3.

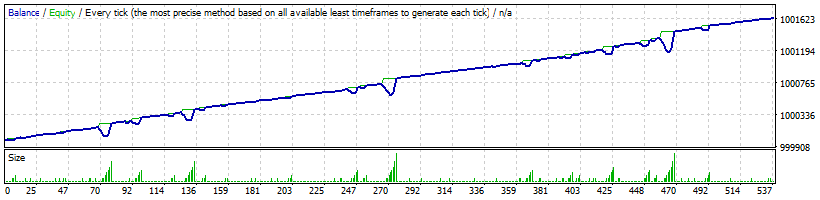

The increase in the timeframe from H1 to H4 led to a worsening in performance. However, even here the trade turned out to be profitable: a positive profit of $ 1.631, a maximum drawdown of $ 683, a total number of transactions of 536, and a maximum position volume 0.11 lot, with the total being just 0.43 lot (Fig. 4).

Fig. 4.

Conclusions:

The conducted testing showed that with sufficiently conservative settings, the advisor 425_Ilan1.6_PipStep can give a stable profit over a long period, with just a moderate drawdown.

Another advantage is that the Expert Advisor does not require one to determine any trends, or calculate anything along the lines of support/resistance levels, reversal points, etc. The advisor also simultaneously works for both buy and sell positions.

The main drawback is the large size of deposit drawdowns during long-term trends, strong gaps, and during events that significantly increase the volatility of the market. Under aggressive adviser settings, such events can lead to a complete loss of the deposit.

Our assessment *

![]()

* - this assessment is made on the basis of our testing in the trading terminal MT4 using NordFX as the broker, and reflects only our opinion. It is possible that testing on other currency pairs, with another broker and under different trading conditions will lead to quite different results.